todayOctober 4, 2021

All Posts Commodities People

All PostsInterviewsNet Zero & ESG

todaySeptember 8, 2022 93 1

Doug Wood, Chair of the Gas Committee at EFET recently joined Ben Hillary, Managing Director at Commodities People for an interesting discussion about developments of markets for bio methane and hydrogen, the fit for 55 package and energy security requirements.

Ben Hillary: We are absolutely delighted to be joined by Doug Wood, Chair of the Gas Committee at EFET, the European Federation of Energy Traders, a role, which I'm sure is keeping him very, very, very busy at the moment. Doug, Welcome, and thanks so much for being here with us. Well, diving right in, what do you think is critical to ensure Europe is really prepared for the winter ahead?

Doug Wood: Well, there's certainly a lot going on at the moment in a number of camps, and the Commission has been working full scale and so have member states and are looking at many of the options available. Certainly storage will be important. And storage filling has been progressing across summer during the objection period pretty well. But we must remember that storage doesn't bring any more gas over the year just gives you optionality when it will arrive, it's not the same as bringing on new deliveries. So that's not going to be enough.

What we are certainly focusing on is in the first instance, energy efficiency is a bit of a no brainer, measures to encourage people to save consumption, to introduce energy efficient vendors, to invest in energy efficiency, and price signals are very important for that. But going beyond that, if we need to protect vulnerable customers and critical industries, during what could potentially be a greater supply shortfall, and not only for Russia interruptions, but also the risk of just general supplier outages, then there needs to be further measures, and this is where the commissions or the measure of interruption of self interruptions or mandatory demand reductions of 15% could become critical in order to allow us to continue. What's important at the moment, is we will need some flexibility around that. We don't know what's going to go on in the outside world and what will continue to affect this, whether winter is going to be a cold winter, a warm winter. So it's going to be really important that we keep a lot of options on the table and we keep some flexibility on the team.

Ben: Absolutely. Well, one of the bright spots right now is that there is there's a lot of excitement around hydrogen and bio methane as vital components of the path to net zero, and also a really major aid potentially for our energy security requirements. How can we kickstart the development of markets for bio methane and hydrogen?

Doug: Well, of course they're going to be of limited help in the short term as it's going to take a bit longer, particularly in the case of hydrogen, because of the levels of investment that will be required, both on the production side, on the storage side, conventional transportation side – and of course, what consumers need to do to be able to burn hydrogen instead of methane. So there's still a lot of discussion going on about how to make that happen. Bio methane is a bit easier given the chemicals constituency of that. But one of the things that are really taking a lot of industry effort at the moment is how we create a good certification regime so that people who buy renewable hydrogen or bio methane can be assured that they are supporting the environmentally green aspects of these things, because once you get hydrogen in the system, you can't tell where the molecules are coming from, whether it's green hydrogen, or it's been produced by some other source – so that can only be done by certification.

At the moment, we have a very complex regime in infancy around guarantees of origin and proof of sustainability around the fungibility between products, and that could be very worrying on two counts. One, unless we can improve standardisation of these kinds of instruments, it will prevent an international market developing whereby we can get clear price signals or: what is greenness worth, and how does that relate to carbon trading, for example. The other concerning thing is how the certificate gets affect commodity markets. You have one avenue of thought that was attempting to track molecules so that if you buy bio methane or green hydrogen, for example, you know exactly where the product is being manufactured or produced and how that gets to you.

Now, of course, when gas gets into the system, it's optimised substituted, so the molecules never actually travel along those notional parts. So, unless we make clear that the certificates can be independently tradable of the underlying commodities, then we can inhibit the markets going forward. But that means we're going to need other solutions to make sure we're not open to accusations of greenwashing, or fraud or double counting.

Ben: Interesting! One final question from my side would be: at Energy Trading Week in London in September, we've got a rather interesting panel that ties into what we've been discussing, to an extent. The panel will be ‘Security of supply vs. fit for 55', moderated by your colleague, Peter Stiles. What are your considerations on the current situation with gas supply in Europe and the Nexus with fit for 55 package?

Doug: Well, Peter will do a great job I'm sure. There are some things, as I mentioned earlier, that are on the nexus of the two things that are certainly something that will contribute to both agendas. For example, energy efficiency, and energy savings. So that's an obvious one that we should be focusing on, and I think that could potentially be a lot more done at Member State and at European commission level – about encouraging people to see that. It's not only about price, but it's about people who can afford to get in the car and drive a bit further or keep the heating turned up. It's helping encourage those people to engage, as well as vulnerable people for whom your energy prices are critical, and you will need some level of assistance.

However, in the longer term, it's a bit different, and we're stuck with the old dilemma of how do you prioritise the urgent versus the important? What I do think is it's a critical period at the moment, as we are developing the building blocks, or encouraging investment in renewables in order to meet the five targets, that we don't lose sight of this, and just forget about it for a few years, or it will be much harder to catch up. So it's important we leave the building blocks know, that we don't get in a situation where whoever would otherwise make investments now be deferring because of uncertainty around the regime, or they don't know how they're gonna be able to monetise the environmental value of those assets.

So it's important we continue to work on these things, and make sure we don't build on any adverse market design issues. But, we have people who could be short of energy this winter, prices have risen to unsustainable levels, we're not really going to have significant additional gas coming on until maybe 2026 and beyond, so we could have a period of tightness for some time. That's why it's important to keep other options on the table; so not only gas, but other sources of energy may need to be extended as well – coal and nuclear.

We've also got the need to continue to invest in other forms of energy efficiency, and this is where price signals will remain important, and the EFET certainly is much more supportive of allowing wholesale prices to continue to be able to signal the need for more imports of LNG or production of higher marginal cost gas or other fuels, and we should really be targeting assistance where it's needed only on vulnerable consumers with direct assistance, but not through price caps. So, there's a number of measures that are possible here, but we shouldn't be compromising achievement of the long term objectives by unmuting investments signals by interfering in wholesale markets in the short term. So it's a difficult balance, and we're engaging with the commission and national authorities in making sure that they're taking advantage and making use of, for example, the EU toolbox that was published earlier this year, so that we can continue to have a market going forward, and we don't throw that out.

Ben: Excellent. Well, Doug, thanks so much for joining us today, and thanks for those fascinating insights. Also, thanks for the really good ongoing work that you and EFET do for the community. We'll hopefully see you and certainly see a number of your EFET colleagues at Energy Trading Week in September. Thanks again for your insights and hope we speak again soon.

Written by: Commodities People

labelAll Posts todayJuly 12, 2022

• How are your investors looking at your business? What pressures do they get and pass on? • What are the ESG requirements at European level? • Indicators and metrics: [...]

labelAll Posts todayMay 15, 2024

Ohio’s net metering program allows you to get credits for surplus energy you produce, which you can apply to future utility bills. The post Ohio Net Metering appeared first on [Read More]

According to the Database of State Incentives for Renewable Energy (DSIRE), Illinois’s net metering policy requires that customers who produce electricity using clean power can take advantage of net metering. [Read More]

The world is getting warmer. Scientists and climate experts say this is because of too many greenhouse gases (GHG) in the air, such as carbon dioxide and methane. These gases [Read More]

Energy systems are becoming smarter and more connected. But with new technology comes new risks. One of the biggest concerns is cybersecurity in energy systems. This means keeping energy infrastructure [Read More]

Understanding energy laws and their impact on energy can help you better comprehend how they affect you and your energy needs. Below, we outline how lawmakers, regulators, and courts steer [Read More]

RSS Error: A feed could not be found at `https://www.energyvoice.com/feed`; the status code is `403` and content-type is `text/html; charset=UTF-8`

Information on energy prices from July 2025, including a breakdown of rates and charges for every region on Flexible Octopus. [Read More]

Get rewarded using energy when the grid is green with Octopus Energy Turn Up Sessions. Instead of wasting all that clean energy, we’d like you to use it up instead. [Read More]

You can make a profit on your electricity bill on the Intelligent Octopus Flux tariff, or save around 90% with Fixed Outgoing. We dig into how saving with solar really [Read More]

Zero Bills Global Standard [Read More]

How zonal pricing could wipe millions off the electricity bills of businesses in critical industrial sectors, including steel, chemicals, car manufacturing, and data. [Read More]

Egypt gets its first large integrated solar PV and battery storage plant — a 1.1 GW solar PV plant with integrated 200 MWh battery will deliver dispatchable clean energy, enhance [Read More]

In the wake of the International Maritime Organization’s vote to price carbon in shipping fuels, I had the opportunity to sit down with an insider and expert on maritime decarbonization, [Read More]

Some companies use the word “eco” in their product names to try to fool buyers into believing their products are good for the environment, or at least, not bad. In [Read More]

It’s Independence Day here in the United States, which commemorates the ratification of the Declaration of Independence (from England) in 1776. What proceeded was millions upon millions — sorry, hundreds [Read More]

Following up on my report on BYD’s car, SUV, and pickup truck sales in June, let’s also have a look at its commercial vehicle sales. The company breaks out electric [Read More]

After years of setbacks, the UK is finally pushing ahead with two carbon capture and storage projects. While there is scepticism about the technology, says Ros Taylor, its supporters argue [Read More]

In 2019, the EU set into motion dedicated legislation to expand renewable energy communities (RECs) where they already exist, and enable citizen energy in countries – mostly eastern and southern [Read More]

Peatlands[1] account for 3% of the world’s land surface. As long as they are intact, they store large quantities of carbon dioxide (CO₂), one of the greenhouse gases (GHG) accelerating [Read More]

The EU promised a renewable energy future – but is it still on track? As political shifts, policy delays and legal battles unfold, the energy transition faces new hurdles. Are [Read More]

On 9 April 2025, Germany’s incoming government of Christian Democrats (CDU/CSU) and Social Democrats (SPD) concluded a governing ‘contract’ that paves the way for the partners to take office in [Read More]

The House version of Donald Trump’s “Big Beautiful” budget bill almost completely repeals the provisions of Joe Biden’s signature Inflation Reduction Act (IRA). In particular, the tax credits for homeowners [Read More]

By Tom Konrad, Ph.D., CFA Supply and Demand One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, [Read More]

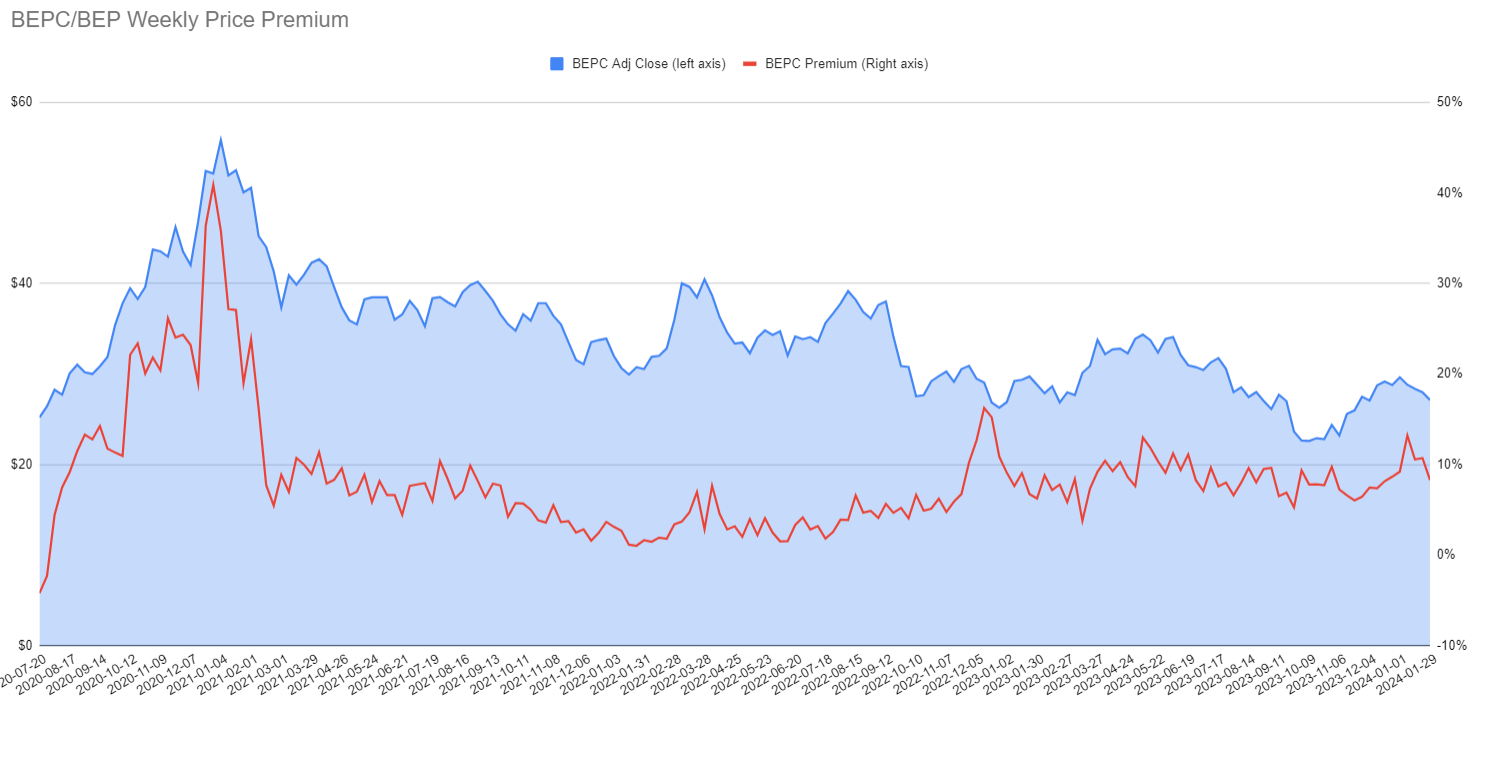

By Tom Konrad, Ph.D., CFA On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. [Read More]

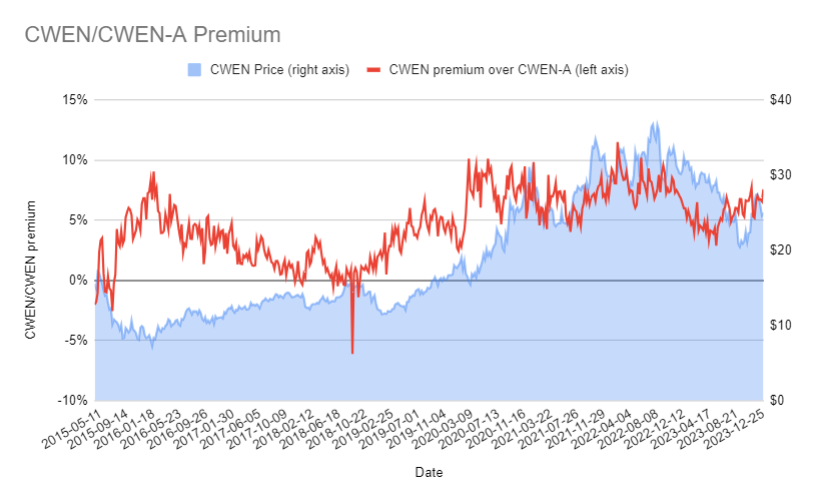

By Tom Konrad, Ph.D., CFA A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A [Read More]

By Tom Konrad Ph.D., CFA Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. [Read More]

With the heat of summer blazing across the United States, you’ve probably given some thought on how to cool down. One appliance that could help is the humble air-source heat [Read More]

With Memorial Day weekend now in the rearview mirror, summer is “unofficially” here. But before the hottest weather of the year rolls in, there’s still plenty of time to make [Read More]

In an era of rising energy costs and growing concerns about grid reliability, power companies around the country are offering demand response programs to help consumers manage electricity use while [Read More]

As springtime rolls in, the season of rejuvenation extends beyond gardens and closets – it’s the perfect time to make changes that can improve how you use energy at home. [Read More]

Thinking about making the switch to an electric vehicle (EV) but unsure where to start? You're not alone. The rapid rise in EV popularity has many consumers considering a move [Read More]

The race is on. Accenture explains why US energy companies will soon be fighting to be methane-mitigation pacesetters. [Read More]

A review of energy sector M&A approaches over the past decade sheds light on four inorganic growth pathways energy companies should consider. [Read More]

Accenture and the World Economic Forum identify five actions to get industries on track for net zero. [Read More]

Accenture identifies three IT enablers of innovation that upstream operators should develop or strengthen to remodel technology. [Read More]

Learn about the six key insights into why—and how—the energy transition must be accelerated. [Read More]

The amount of clean, homegrown energy from onshore wind is set to accelerate over the second half of the decade as the government launches the first ever onshore wind strategy. [Read More]

Aneo has entered into an agreement with KGAL Investment Management to acquire the Bäckhammar wind farm, located in Kristinehamn municipality in southern Sweden. [Read More]

Minesto is heading a consortium that has been awarded a total of SEK 25 million grant funding from Swedish Energy Agency to build a complete microgrid installation in the Faroe [Read More]

DEME has celebrated the launch of its second wind turbine installation vessel, Norse Energi, at the Yantai CIMC Raffles Offshore Ltd. [Read More]

Orica has been conditionally awarded AUS$432 million in ARENA Hydrogen Headstart funding to support the operation of the Hunter Valley Hydrogen Hub. [Read More]

Copyright 2023 Commodities People

MOLECULE

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

MOLECULE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

cQuant.io

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

CAPSPIRE

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

CAPSPIRE

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

DIGITERRE

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

DIGITERRE

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

EMSYSVPP

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

EMSYSVPP

GOLD SPONSOR

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

ENERGY & METEO SYSTEMS

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

ENERGY & METEO SYSTEMS

GOLD SPONSOR

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

FIS

GOLD SPONSOR

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

deltaconX

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

deltaconX

GOLD SPONSOR

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

Energy Exemplar

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

Energy Exemplar

SPONSOR

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

REDEX

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

REDEX

SPONSOR

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

ENERGY TRADERS ASSOCIATION

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

ENERGY TRADERS ASSOCIATION

ASSOCIATION PARTNER

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

STA

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

STA

ASSOCIATION PARTNER

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

EUROPEAN ENERGY RETAILERS

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

EUROPEAN ENERGY RETAILERS

ASSOCIATION PARTNER

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

ENERGY TRADERS EUROPE

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

ENERGY TRADERS EUROPE

ASSOCIATION PARTNER

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

AIGET

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

AIGET

ASSOCIATION PARTNER

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

CTRMCENTER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

CTRMCENTER

GOLD MEDIA PARTNER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

TRADE FINANCE GLOBAL

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

TRADE FINANCE GLOBAL

MEDIA PARTNER

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

Post comments (0)