todayOctober 4, 2021

All Posts Commodities People

All PostsMarket DynamicsMarket Updates & OutlookRiskWebinar

todayMarch 28, 2024 474

As we move further into the Energy Transition, the portfolio-level impacts of renewable energy procurement and electricity decarbonization are becoming increasingly apparent, prompting a shift from “project-by-project” decision-making to more holistic total portfolio planning and analysis. Whether on the buy or sell side of a project or contract, the intermittency of wind and solar generation requires diversification and risk management considerations be acknowledged at the point of origination. As such, the way in which today's energy portfolios are built is just as critical to long term success as the way they are managed on an ongoing basis.

This webinar will explore the risks embedded within today's energy portfolios and offer strategies to help growing portfolios maximize resiliency against rapidly-changing market environments. Attendees will learn:

SPEAKERS:

David Leevan

We'll give everybody a minute. Brock.

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Sure.

David Leevan

Okay. Welcome. Hello and welcome to today's webinar building portfolios for the energy transition, hidden risks and strategies for success my name is David Levin. I'm the CEO of Ceqant IO. We're here today to explore the risks embedded within today's energy portfolios and offer strategies to help energy companies maximize resiliency against rapidly changing market environments. Ceqant IO is an industry leader in analytic solutions for energy and commodity companies. We specialize in total portfolio analysis. Sequant's cloud native platform enables physical asset, financial, contract market simulation and risk management analytics all in one place. And Sequant is the only platform where companies can see an accurate forecast of expected value and value uncertainty at any level of the portfolio and develop hedging strategies to achieve optimal outcomes. On behalf of Ceqant, I'd like to give a special thanks to commodities people for supporting and promoting this webinar. We love working with commodities people. We feel like they have the best energy events in the industry. A couple quick housekeeping items before we get started. If you'd like to ask a question during the webinar, you can do so using the chat box on the right hand side of your screen. We have a large number of people that have registered for this event, so we might not be able to get to every question live, but we'll do our best to get to as many questions as possible. In addition, the webinar is being recorded and will be reposted on Sequant's website. All that said, I'd like to now hand it over to Brock Masafki, sequence vp of analytics. Barack, please take it away.

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

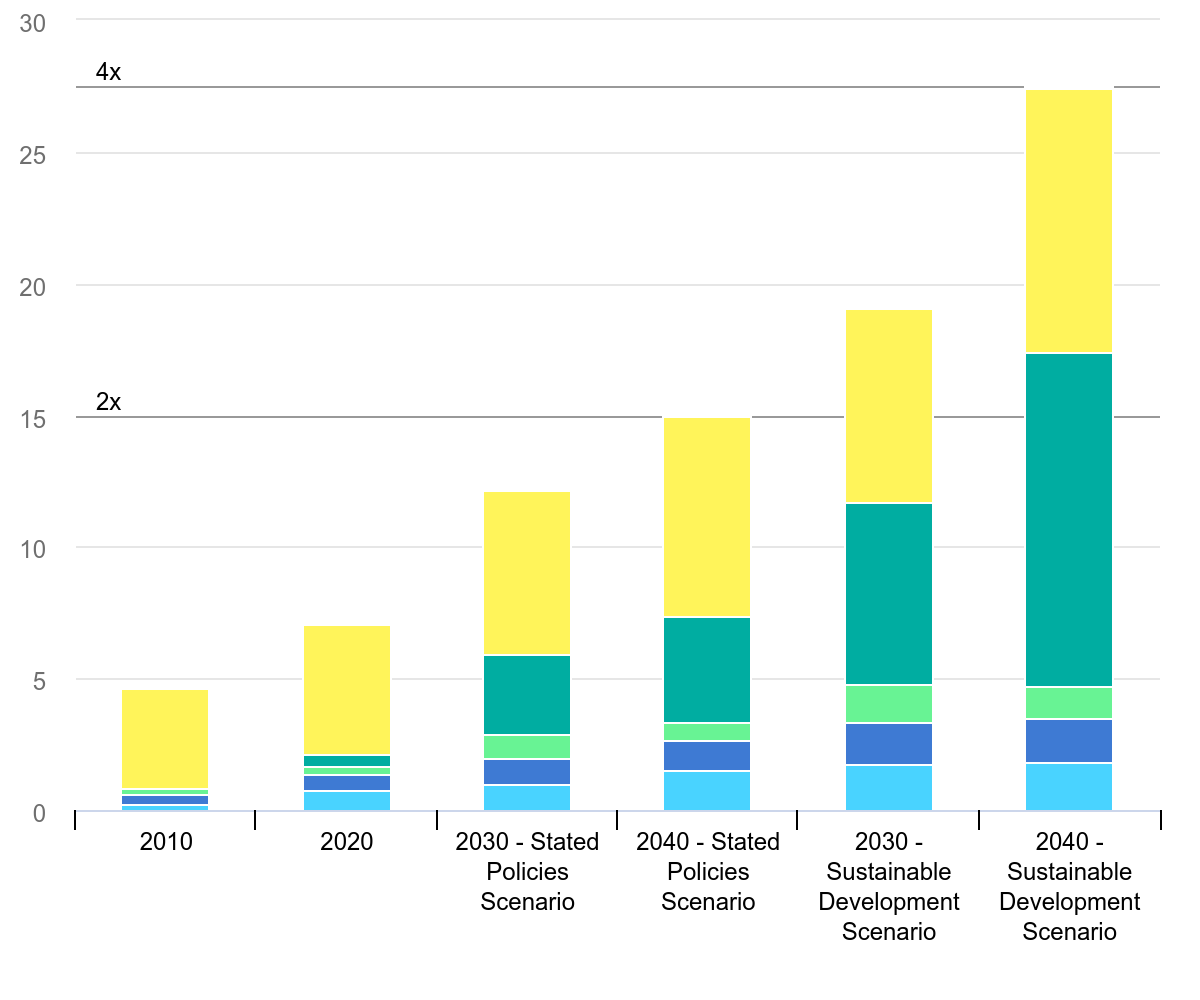

Great, thanks so much David, and thanks to everyone for attending this event. I think we have some really great content for you today. We're going to start off with a presentation which you should be seeing on screen around building portfolios for the energy transition. We'll talk through some of the hidden risks within the energy transition and we'll outline some strategies for success. And then we have a great panel discussion planned with a broad swath of different industry participants. So I'm really looking forward to that. So let's dive in. So we'll begin by just putting some structure around what it means to build a portfolio for the energy transition. Right? This is different assets and contract types, locations, tenors, markets. There's a lot of diversity within energy portfolios today and so that's something that adds complexity to these portfolios. We have multiple attributes that we need to track simultaneously. So it's not just about the cash flows and the energy positions. We're now also concerned with renewable energy certificates, resource adequacy, GHG free requirements, carbon tracking, other emissions tracking, and the number of attributes we have to simultaneously track is only growing over time. So that's an important component of today's portfolios as well. These portfolios also often include, and typically include long term positions. So physical assets with 20 or 30 year lifetimes, power purchase agreements with 15 to 20 year tenors. Right. And there's little ability to hedge far out on the curve. So we have some flexibility near term, but we have to be actively managing these things and we'll unpack that a little bit along the way here. And kind of an overarching concept that I want us to keep in mind as we go through the presentation and the panel discussion is that when it comes to energy portfolios, and really portfolios in general, the whole does not equal the sum of the parts. And this is especially true regarding risk. And we'll again dive into that a little bit in the coming slides. So I wanted to just introduce quant at a very high level for those on the call who may not be familiar with us. Ceqant is a cloud native software as a service energy analytics provider and an analytical partner to all our customers. And so we have a very broad range of capabilities that are custom tailored to the energy industry. You can see those on the right here. I won't bore you by going through every single one of these, but they broadly segment into asset valuation, risk management, portfolio optimization, use cases and there's a variety of different kinds of nuances within there, so very relevant to the topics that we'll be talking about today. And we work with a variety of different industry participants. So utilities and other load serving entities, renewable developers, consultancies, independent power producers, trading organizations, and corporate off takers of PPAS, among other types of organizations as well. And we do have a global solution. So I saw in the chat there's someone attending from Greece and other parts of the world. So that's excellent. Welcome. Let's begin by just outlining some of the high level risk drivers that are associated with the energy transition. Certainly market price level is a really important one of these. The level of market price is influenced by a whole bunch of different things and there's a lot of uncertainty in how that's going to evolve and we'll unpack that a little bit more. Hourly shape is extremely important when we look at these portfolios: the hourly shape of price, of generation, of demand, of weather, and all these elements covary with one another. And so the covariance within the portfolio and the covariance within the factors is an important thing to consider as well. That's kind of related to the next one, which is the basis, which in the US power markets is extremely important. But the concept is starting to also move into other global markets as well. And it certainly exists in other commodities like natural gas and other refined products. That's something where there's a differential in price between two different locations on the grid, or two different receipt points on the gas transmission system. We'll also unpack that a little bit, and then there's many other risks that are relevant as well. Oversupply risk. When you're looking at a portfolio that's natively short, total production volume uncertainty due to the intermittency of the assets, operational uncertainty, counterparty credit exposure, these are all things that play into today's portfolios. So we'll go through a couple of these kinds of main risk factors and unpack these just a little bit. And the first one we'll start with is power price level. So, when we think about price level, think about kind of the monthly average spot price, right? Where is the market located as we move through time? On the right here, we have an image of ERCOT north day ahead average monthly spot price over five different historical years. And you can see how much uncertainty there is, and how these prices can realize there can be extreme volatility events that push the price up, there can be dramatic variation from year to year, and there's a whole bunch of different things that impact the market price. When we think about renewable energy, extremely important for the energy transition and oversimplification is basically high prices are good, low prices are bad, right? We're long energy, but we have to think about when renewable energy is generated. And so we have to be able to capture those prices. With generation. There's many factors that drive the overall price level. Natural gas prices are still a very primary driver. There's still a strong correlation because of the need for natural gas generation on the grid. Supply stack evolution and load growth are extremely important and can move the price around. Transmission availability and the possibility for congestion also can impact prices. And there's many, many other drivers as well. So, price level is extremely important, the way that monthly average prices are fluctuating. But we can't just look at monthly prices when we're thinking about intermittent renewables. We have to dive down to the hourly level and look at hourly shape. Expected. Hourly shapes of generation and power prices have a very primary impact on renewable capture price. The capture price is basically the generation weighted average price. It's the average value delivered for each megawatt hour generated. And on the right here, we have a variety of different shape factors for southern California. The dashed line in black is the solar profile in the region. And these are kind of normalized shape factors. So they're showing relative differences across a day. So you can see how that varies across the different months of the year. And then the colored curves show the price shape factors from three different years in history, 2013, 2018 and 2024. And so we can see the evolution of how price shapes have changed over time. And this duck curve phenomenon in California, which is really the result of overproduction of solar in the midday and a reduction in market prices, and then again, kind of a pop in those evening hours, has dramatically changed power prices in California over the last decade. The summer peak price has moved from hour ending 17 in 2013. You can see where that peak price was, and it shifted 3 hours to the right. So later in the evening, to the point where the peak is now entirely outside of the solar generation hours. That's a pretty dramatic change in the nature of how those prices are materializing. Midday prices have tanked, right? They've gone way down relative to what we saw in 2013. And that's, again, that's due to the oversupply in the region of solar. And negative pricing is quite prevalent in California now in the middle of the day. And if we zoom in on a particular month, like August, the top two priced hours, which are highlighted in this red bar here, you can see that those are fully outside of the solar generation hours. So there's very little solar generation that's able to capture those prices, and that creates risk in portfolios and something to be conscious of. And this duck curve phenomenon is now moving across the country. It's occurring everywhere. We've already seen the ERCOT summer peak shift to our ending 19, so it's following suit in California. And the northeastern markets are also showing the same trend. And so this is something that we expect to persist in terms of hourly shaping across various different markets. We can also think about covariance, and that's an important risk factor within today's portfolio. So, renewable generation, because of its intermittency and because of the general non-storability of energy today, tends to be strongly anti correlated with price. So that means the more generations we have, the lower the price tends to be. And you can see that borne out on the right here. This is SP 15. So, Southern California prices and solar generation from October 22 through September 23. And these are hourly prices and generation. So you can see on the x axis is the generation, the y axis is price. And you see those clusters tend to occur down and to the right on these plots. So that means that the more generation there is, the lower the price tends to be. And this is stronger than just shape. We talked about price and generation shape, but this is really a structure in the uncertainty around the shape, and that's important to acknowledge. So what that means is that higher than expected generation tends to align with lower than expected market prices. And that's something that can dramatically impact valuations and needs to be taken into account. It also reduces the effectiveness of renewables as a hedge against load, because when you have those renewables and they're generating, the market price tends to be lower. And the opposite is true. The market price is higher, and load becomes more expensive to serve when you don't have those renewables. So it's kind of adding the wrong way to risk the portfolio. We can think about basis, which is kind of a particular type of covariance, but across different locations on the grid. And when we look at generators, the nodal basis at a generator node is typically strongly negative because of the one way power flow coming out of the generator. So on the left here, we have a historical time series for a particular basis in California. Again, southern California, from a solar node to, to the SP 15 trading hub. And in 2021, you can see there was a dramatic basis impact. In July and August, there were these basic blowouts where the nodal price was $400 in some hours less than the hub price. And you can see that overall, the basis has been negative. On the right, we have some statistical confidence bands of the basis spread. This goes from the p five, or a one in 20 downside basis event. On the bottom, the expected value, in the middle, the expected basis, and then a one in 20 upside or a p 95. So nine times out of ten, you would expect the basis to be somewhere within these bands. And again, these statistics show that the basis is primarily negative and can be dramatically negative in certain times of the year. Now, the reason that this basis is important is it creates slippage in hedge effectiveness within the portfolio. And so often hedges will be enacted at the hub, whereas the generators are compensated at the node. And so differentials between the price at those different locations can reduce the effectiveness in a hedging strategy. And the basis is also strongly location dependent, and it's constantly evolving as the grid changes, as the supply and demand dynamics change, as power flow changes on the grid. And so, something to definitely be aware of within our portfolio analysis. The last component of risk that we'll dive deeply into here is what we call oversupply risk. And this is relevant to portfolios that are natively short, that have a demand position. And it results from the hourly shape mismatch between renewable supply and the native demand. It can lead to oversupply in certain hours. If we look at the image down and to the left here, this is showing energy shapes for July. We have electricity demand in red, for example, data centers. So a very flat, stable load. And then we're supplying this with renewable energy. And we've contracted such that at the annual level, we're 80% renewable now. Because solar doesn't generate in the middle of the night, we need to over procure during certain hours of the day so that our net kind of megawatt hour position at the annual level nets out to 80%. What you see is that that results in pretty significant oversupply. Again, these are confidence bands with the solid line here being expected generation. But that expected generation is far above the expected demand, and that flips the native position from short to long. What that effectively means is that once we get above that demand, every additional renewable energy megawatt hour that we add is actually increasing risk, not reducing it. It's not hedging a position, it's adding length to the portfolio. And if we look at how that cashflow at risk responds on the right here, you can see that as you continue to increase renewable energy to a point, we reduce the risk and then it flips around and we start increasing again. So by the time we get to 80% renewable across the year, we're already on the upswing. So this oversupply is something to be aware of within portfolios that include a native demand position. So how can we build a portfolio that is robust to these risks that come with the energy transition? That's kind of the driving question for the remainder of this presentation, and we'll talk through three main strategies for success. The first is built in diversification. So that's thinking about the diversification within the portfolio as we're contracting, as we're adding assets. And we'll unpack each of these in detail on the coming slides. The second strategy is active management and active hedging. So a very targeted hedging strategy that's designed to reduce risk and is done in kind of an ongoing manner within the portfolio. And the third is planning across different attributes and forecasting how those attributes will fit together in the broader portfolio. So we'll dive into each of these now and kind of give some examples of how they can be put into practice. So the first is this idea of built in diversification. And that's the idea that we want to prioritize assets or contracts that naturally stabilize portfolio cash flows and thereby reduce risk. On the right here, the image shows a portfolio that consists of just physical assets. There's no financial hedges, no contracts in here. It's just the physical renewable assets, both wind and solar. And the blue here is what we think of as an undiversified cash flow position. This is a four year cash flow. So looking at a broad timeframe and understanding the total cash flow within that portfolio forecasted, you can see there's a lot of uncertainty. So the blue distribution is going all the way from about $400 million all the way up to $1.8 billion of margin over that interval. And so there's a lot of uncertainty. The red here, excuse me, the blue is the undiversified portfolio. So that's the cash flows under the assumption that every single one of the assets in the portfolio is perfectly correlated with all the others. So when we see a downside event, we see a downside event for every asset. Now, that's not truly how portfolios behave. Not every asset is going to realize its downside scenario simultaneously. And so the red is the true portfolio. That's accounting for the diversification effects in the portfolio. And you see that the distribution is narrower, meaning that the cash flows are more certain. And particularly if you look at this downside tail statistic, this p five or a one in 20 downside event, it's increased here by $54 million. So that's a pretty significant impact in terms of the risk or the downside, and mitigating that downside, just from the nature, the structure of the assets in the portfolio. Again, there's no targeted hedging strategies here. This is purely a diversification benefit. And so when we think of that diversification, we can think in terms of asset type. So you can have wind and solar and hydro battery storage, other types of assets as well, that diversify the portfolio. We can think across different settlement locations, different projects, so we have geographic diversification as well. And we can think in terms of hourly shapes. So, you know, different, different alignment of the hourly shapes within the portfolio can provide diversification benefits. And as we go through each of these strategies for success, each one of them really relies at its core, on having a strong analytical framework. This is a very data driven portfolio management perspective, and so I'll try to highlight what the analytics requirement is for each of these. In this case, we need an analytics framework that can quantify and assign value to in a very objective way and repeatable way, the portfolio diversification benefits. And that's what we're kind of doing here with this distributional analysis. We want to be able to take that into account at the time of asset purchase or contracting. The second strategy we'll go through is active management or hedging. The idea here is to optimally hedge using standard traded products, swaps, options, the like, really. This is kind of typically focused on hedging near term months and then rolling those hedges forward through time. Because we don't have liquidity, we can't go out on the curve in ten years and lock in our position at that time. We need to kind of roll the hedges forward. So that's part of why this is an active management strategy. It's kind of ongoing. And hedges should really target the portfolio level. They should target risk reduction at the portfolio level. We don't want to develop individual strategies for each asset, because that's ignoring some of those diversification benefits that we already talked about. Right. So, on the right here, what we have are some example hedge optimizations for three different markets. Caiso in red, ercot in green, PJM in blue. On the x axis here, we're looking at different hedge volumes of a kind of standard block product here. Seven by 16 hedge. And we're hedging a solar asset. In each of these locations, we're hedging 100 megawatt solar assets. We know that there's going to be some shape alignment, excuse me, some shape misalignment, because the block hedge doesn't look like a solar profile. But what's the best we can do? And that's what we're seeing here immediately, you can see there's dramatic differences across markets. So the optimal hedge in Caiso in August is 10 mw here. Remember, this is a 100 megawatt solar facility. So this basically says it's optimal not to hedge very much at all in August. If we look at ErcoT, however, we can hedge 40 Mw. That gives us the best risk reduction. So there's cross market impacts. Every location on the grid is going to be a little bit different. If we go down to February, we can see again that there's stark differences across the different locations. But now, Caiso can accommodate much more hedges. We can hedge at 30. That becomes optimal here. Really, the analytics requirement here is we need to be able to tease this out. We need to be able to identify the optimal products, the optimal locations, and of course, the optimal volumes, and acknowledge that every asset within the portfolio is going to have a little bit of a different strategy. And these need to be pieced together in a way that is right for the portfolio, not just the individual assets in isolation. The last strategy that we'll talk about here in terms of managing and building portfolios for the energy transition is the idea of cross attribute position planning. This is becoming extremely important for today's portfolios. It's the idea that we need to be managing the net position of multiple different portfolio level attributes, not just cash flows and our power position, but also renewable energy certificates, resource adequacy, and ghg free requirements. Carbon is becoming increasingly important to actually track carbon position and carbon volumes. When we're looking at scope one, two and three reductions, being able to track these simultaneously and track progress toward different targets becomes very, very important. We also need to understand how generation intermittency affects the outcomes within the portfolio. If we have a month where we have reduced wind generation or reduced solar generation, we're not going to get as many wrecks into the portfolio. And if we have targets that require those wrecks, then we have to go out to the market and purchase them to backfill. Well, if our assets have underperformed, it's likely that other assets in the region have also underperformed, and so other organizations are short on their targets. So that puts pressure on the market and it raises prices for those attributes. So just as there's a supply and demand dynamic that pulls price around on the electricity side, that's also true for these attributes. And so being able to manage that holistically becomes very, very important. So on the right here, the images show three different attributes that we're tracking within an example portfolio. The first is the net cash flow, the margin across the portfolio. The net cash flow is in black here, and you can see there's strong seasonality. We can see how the margin breaks out across different asset classes. It's probably a little bit small on screen here, but the green is the retail revenue. The brown up here is the thermal generation. There's revenue coming from solar power purchase agreements in yellow here and then firm contracting here. So we can see how that margin breaks out and manage the seasonality. We can also look at the megawatt hour position, our power position across the portfolio. Now, this is a load serving entity's portfolio or kind of reflective of that. And so we can see we're net short here, but we can see which elements are contributing to that position. The yellow here again being thermal generation and solar and wind and all the different elements. And that seasonality is different from the cash flow seasonality. And finally, we can look at Rex, very strong seasonality of Rex here. We can see hydro in green and solar in blue. And that's really contributing to the portfolio. And that seasonality is still different, right? So when we're managing all these different targets, we need to be able to kind of analytically bring all this information together at once. And ideally we want to stochastically forecast the net position and the uncertainty in that volumetric position for all relevant attributes simultaneously. Three strategies just to bring this back together and conclude some portfolio level impacts. When you're building a portfolio, you need to think about it at the portfolio level and you need to do that as you're adding new assets and contracts, looking at the incremental change to the existing portfolio. Because these things are not contracted in a vacuum, diversification benefits should be quantified and they should really be incorporated into the asset or contract decision making process. Diversification has real value to the portfolio and by baking that in, that makes the portfolio much more resilient. Over time, active management and hedging can produce significant risk reductions, but it requires ongoing attention. When we're building portfolios and we're building the organization that's going to manage that portfolio, this is something that we need to acknowledge will continue over time. We need the ability to roll the hedging strategies forward. Building a strong portfolio involves more than just energy and cash flows. These attributes, reqs, resource adequacy, emissions volumes are becoming increasingly important to managing these portfolios. At the end of the day, a strong analytical framework is essential to success in managing and building portfolios for the energy transition. So thanks very much for everyone's attention here. This is the end of the presentation segment, so I'll leave this kind of contact slide up on screen here for a few minutes and turn it over.

Howard Walper, CEO, Americas at Commodities People

Great Brock, thank you very much. It's a pleasure to be here. My name is Howard Walper. I'm CEO for the Americas for commodities people and I'll be moderating the panel discussion portion of this program. Yeah, we've had the privilege of working with the folks at Deqwon for many years now. It's a great group of people, very talented, talented individuals. So we're about to dig into this panel portion. But before we start, we'd love all of you in the audience to participate in this conversation. So if you have any questions, please do submit them into the q and a box. Not the chat box, the q and a box. There's a and a button at the bottom of your screen.

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

We're going to get to as many.

Howard Walper, CEO, Americas at Commodities People

Questions as possible at the time we have allotted. And of course, if we don't get to them, the folks at cQuant are always happy to chat with you. They had an address posted a moment ago. Please feel free to contact them directly if we do not get to your questions. So at this point, I'd love to invite all the panellists to turn on their cameras and join us on screen here. Excellent.

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

All right.

Howard Walper, CEO, Americas at Commodities People

Well, you all have met Brock at this point, so why don't we go around the table and have everybody introduce themselves briefly. Chris, why don't we start with you? Why don't you let the folks know who you are?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah, sure. Hey, Chris Huberti here. I am with Microsoft. I sit on our energy risk analytics teams, which sits within Microsoft and does the analytics forecasting, some tooling development for our energy portfolio within our cloud operations business. So that's our data center, load plus our renewables portfolio, tracking, energy forecasted, spend attribute tracking, all that sort of good stuff.

Howard Walper, CEO, Americas at Commodities People

Wonderful. Roger, how about you? Why don't you let the folks know who you are?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Yeah, sure.

Roger Tabet – Senior Principal – Quantitative Risk Analyst, Portland General Electric

Hi, everybody. I am Roger. I am a senior principal in quantitative risk analysis at Portland General Electric, and I have been looking at risk and analytics for about 15 years now in various different companies.

Howard Walper, CEO, Americas at Commodities People

Wonderful. And why don't we wrap things up with Robert? Robert, tell the folks in the audience a little bit about yourself.

Robert Harding – Energy Storage Business Development, National Grid Renewables

Good morning, everyone. I'm Robert Harding. I work on the battery storage team at National Grid Renewables, which is a developer and a owner and operator of power plants, renewable power plants and batteries, that is with about a gigawatt under management.

Howard Walper, CEO, Americas at Commodities People

Wonderful. Well, let's get to the first question. How important are diversification effects to your organization when making decisions about new assets or contracts to add to the portfolio? Maybe we could start with you, Roger.

Roger Tabet – Senior Principal – Quantitative Risk Analyst, Portland General Electric

Yes, sure. They are definitely extremely important, too. That's pretty much the core of what is happening these days. Because indeed, as Brod showed, you cannot rely just on one just source location type of shape, intraday or intramont or intra year. And you need a lot of different shapes to make sure, one, you serve the load, and two, you can optimize your financial risk, which are usually, not just usually, but the two really big worries you need to keep in mind are really the price and the reliability. So you do need to diversify a lot, and you don't have a choice. You need to pay the price for that.

Howard Walper, CEO, Americas at Commodities People

Chris, did you have any thoughts on that?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Chris?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah. So for us at Microsoft, the portfolio level analysis is kind of everything for us. Our data center load is kind of spread off, spread around the world, very geographically diverse, very market diverse, and then even our billing structure for that load is pretty diverse in terms of what mix of data centers are on fixed rates versus market based rates. So it creates a lot of short risk for us on the load side. So our renewable portfolio is pretty critical in managing that financial risk and then also obviously meeting our sustainability goals. So kind of a combination of citing different assets in different markets really is an invaluable tool in order for us to balance some of that capital risk that we see with our data center growth.

Howard Walper, CEO, Americas at Commodities People

And Robert, did you have any comments?

Robert Harding – Energy Storage Business Development, National Grid Renewables

Yeah, and I think our perspective as a developer and power generator is flipped from Roger and Chris, who are managing these firm loads. And if you don't supply it, the lights might go out. Well, we're not managing to a firm load, but we are managing to a firm cash flow or as firm as possible, ideally. And so as our portfolio has grown and we have these different renewable assets with intermittent wind and intermittent solar and different contracting structures on this subject to different prices in different markets, it's gotten complicated pretty fast. And for us, we started with the idea of diversity as an appealing concept. And we have a pie chart, and we're going to do so many megawatts in one market and a different market, and of one asset and another asset. And that's worked well for us. It has. But as we're growing, we think we can do it better. And that's where sequant helps us turn this generic idea of diversity into a more powerful idea, because now it's quantified and we can now manage how we're developing, where we're developing, what we're developing, and how we're contracting.

Howard Walper, CEO, Americas at Commodities People

And Brock, I think you have the opportunity to back clean up on this question. So, any thoughts?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Yeah, absolutely. I mean, I think it's great to hear the diversity of perspectives. Right. I mean, Roger is speaking from a utility perspective. Chris is speaking from an off taker. Robert is speaking from a developer. And the diversification within the portfolio is critical to each of these different applications. Right. And it's great to hear the quantitative nature of being able to assess it is something that people are starting to take note of and to do this more proactively, because one of the things, especially with renewable portfolios and renewable contracting, is once you sign that PPA, it's set. It's going to be very expensive to go and renegotiate the PPA. You can't do much hedging out on the curve. What are you left with? You're left with relying on the statistics that exist within that intermittent renewable energy, and they can be pretty material. They can offer diversification and risk mitigation. So I think I'll just underscore the points that all the panelists said. I think it's great to see the diversity of perspectives on portfolio diversification.

Howard Walper, CEO, Americas at Commodities People

So how does renewable matching to customer demand play into portfolio management? I guess different granularities of matching annual, monthly, hourly. Robert, did you have some, you had some thoughts on that, I believe.

Robert Harding – Energy Storage Business Development, National Grid Renewables

Yeah, and I think we're, as a developer, newer to the game, so I'm curious to see what the others are saying about this as well. But for solar and wind tracking attributes, renewable energy credits are fairly easy. When the sun shines and you spin the meters or the wind blows and you spin the meters generating reqs and you're selling them as you're obligated to. There's this new world developing, which is helpful for folks like Microsoft and Google and anybody who really wants to get to net zero or near zero energy, you want to know when and where your energy is coming from. And so now we have batteries which can sort of store wrecks and then put them back out onto the grid. This is something that we're still working on, but it does start to get complicated with the details of how you track this. And is this credible? Is one rec equal to another? And managing these price curves is just another layer of where this whole thing is going.

Howard Walper, CEO, Americas at Commodities People

Chris, to, would you like to weigh in on that?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah, on the flip side, from the off takers perspective. So for Microsoft specifically, we have kind of a yearly granularity goal for 2025 for annual matching of our recs globally. But then our more aggressive goal is in 2030 to have 100% of our energy, 100% of the time be zero carbon. And that's where we start getting the granularity of the hourly granularity and doing that analysis across our portfolio, which is really a lot of interesting, pretty exhaustive work for our team that we do a lot of work on. Those are the main buckets that we tend to look at at the moment. But again, it's an evolving thing as new technologies, new contract types come into existence. So yeah, there's a lot of innovation there, it seems like.

Howard Walper, CEO, Americas at Commodities People

Excellent. And Roger, how about you?

Roger Tabet – Senior Principal – Quantitative Risk Analyst, Portland General Electric

Yes, there's a lot to think about here, but indeed you mentioned basically reliability hobboard, which is indeed the first problem really is keeping the lights on and making sure that at not you do that at not crazy prices too. So two are really financial risks. And then of course, as Robert was talking about, we are now starting to have almost a third problem, which is really carbon neutral or really having at least knowing your carbon net impact, not just carbon, by the way, we say carbon, but there are other types of pollution out there. And that is really a third type of thing you need to keep in mind. Of course, you do need everything you can to diversify all of those. And they actually turn to resources and contracts. If you work around them correctly and you look at their distribution of risk. Indeed, either if you simulate or if you can do it analytically, but you cannot do analytically for the whole portfolio, then you can start understanding where have you really your short, not in the traditional way, short position, but either short reliability, short financial risk and short carbon or rate too, depending on the market rate. And carbon can be both existent or non existent. And you need to look at all of everything you're trading or where you have activity or an orchestra load really is what matters because we're a load serving entity.

Howard Walper, CEO, Americas at Commodities People

And Brock, once again, I think you get the closing comment on this particular topic.

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Yeah, so it's, you know, this kind of goes back to some of the material in the presentation that's looking across attributes. So you're managing energy balance has been important to portfolios for long time and energy balance on the grid. Right. Because essentially you have a non storable quantity. Now we're starting to apply that same instantaneous balance in terms of time and space to other attributes as well. So we're imposing a great deal more complexity on these portfolios by requiring them to be renewable 100% of the time. And that is something that really plays out in the statistics. It's something that is cross attribute, it's cross location. There's all kinds of statistics that come into play there. When we think about the granularity at which we're trying to match attributes to targets, we start saying, well, we still have the megawatt hour supply and demand balance that we have to maintain, but then we're adding potentially renewable energy certificates and carbon and all these other things simultaneously. You have individual assets that can contribute to multiple attributes, and sometimes in even different ways in different amounts. And so that complexity starts to get to a level where I think that really starts to reveal the need for analytics. You need a way to track that, you need a way to run scenarios as you're planning, because if you procure one versus another asset, it may completely change your attribute position. And wind and solar is a great example because those assets tend to be somewhat anti-coincident in terms of their hourly operation in most markets. So looking at the potential for wind to match, kind of that 24/7 goal versus solar becomes something that you need to quantitatively assess and understand the impacts. The more granular those targets become, the more costly they can be to satisfy and the more management they require.

Howard Walper, CEO, Americas at Commodities People

Excellent. Well, let's shift targets a little, shift topics a little bit into the role of battery storage. Maybe we'll start with Robert one more time. What is the role of battery storage in growing energy portfolios?

Robert Harding – Energy Storage Business Development, National Grid Renewables

Yeah, and it's a good transition here, Howard, because I was actually going to riff off of Brock's comment there, because the attribute tracking and the way this interacts with the mechanics of the battery are complicated. And I think aligning industry alignment on how this works would help finance projects like that and get more 24/7 or near zero renewable deals done. So one big misconception I see in the battery world is that if I have a solar and a battery and they're next to each other, that does not mean that the battery is charging from the solar. In fact, if you follow the wires, it's actually charging from the grid. Unless we flip the switch and make it charge from the solar, we can do that. We generally don't. It's not very economic, there's more losses, all kinds of stuff. So now we get into tracking Rex. If I'm charging my battery while the solar is generating, is it 100% clean or I'm technically charging from the grid, is there actually some carbon in there? Does that count? Can we agree or is it getting too complicated now? And that agreement is critical because I can't finance a battery on a hope and belief that 24/7 rex will become. Yeah, it will become so valuable. And I need to know what I need to do with my battery to satisfy this performance, and then I can manage it, and I can do that all day, every day. But I need a price and some performance obligations. And that's how you can actually affect this this idea that everyone agrees on, that let's charge when the wind is blowing or the sun is shining and discharge it later, like that's happening anyway, it's just the mechanics of the credits and the tracking and the payments that we all need to figure out a little bit better.

Howard Walper, CEO, Americas at Commodities People

Chris, how much, how do you view this issue?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah, I mean, same thing that, as I kind of mentioned earlier, we do have goals that go down to the hourly granularity to match our load profile. So for us, going out and finding firm blocks, renewable contracts is very useful for us. But as art mentioned, there's challenges that go along with that. Obviously, those that we have are few and far between. They're very useful in the individual portfolios or the markets that we have them in. But for us, that's just one tool that we use to achieve our goals. Getting back to the broader portfolio and out like a portfolio, look at things. We really utilize the combination of technologies to match our load profiles across our region. So the combination of wind and solar wind becomes increasingly important to meet some of those 24/7 goals of our data center loads. And then the second challenge that we have is that our load profile is changing. Traditionally, we've had cloud based data center load, which is, generally speaking, relatively flat, transitioning to AI data centers, which can be a lot more variable than traditional cloud data centers. As far as their load goes. Meeting that challenge is the next frontier of what we will be tackling. I don't have the answer to that, of how we're going to do that quite yet.

Howard Walper, CEO, Americas at Commodities People

Well, we'll get there. Roger. In terms of reliability, what do batteries bring in terms of reliability?

Roger Tabet – Senior Principal – Quantitative Risk Analyst, Portland General Electric

They're amazing. They're as simple as that. They're really the dream of everybody who worries about reliability, because indeed you keep this battery of energy. And for the super peak hours, really, and as Brock was showing in the presentation, especially with the dirt curve phenomena, you need those at super peak hours, which happens now more and more after the sun goes down. So in this region where we are in the Pacific Northwest, here we have some hydro, but not everybody everywhere has access to hydro, which is another way of really shifting energy inside the day, sometimes inside the months, very, very, very rarely inside the year. But it's definitely a big, big tool for reliability. Now, an interesting thing is it's hard to also use batteries to optimize prices or to optimize carbon. It's hard to do everything at the same time. So you have to pick a little of your poison or what you want to achieve first. And that usually depends on your diversification and your time horizon while you're looking at risk. So in the very short term, you're extremely worried about reliability, and longer term, you, you do both, really. You mix all of those.

Howard Walper, CEO, Americas at Commodities People

Excellent. And Brock, what are your thoughts on batteries here?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Yeah, I think one of the things that Roger said is pretty key here is that Roger mentioned the use of batteries, the use of hydros, and if we broaden it beyond batteries to just think about energy storage, I think it's quite apparent that as we move toward a more and more renewable centric grid, that some sort of energy shifting capability is going to be critical. Now, the way that batteries have mostly derived value to date and the batteries that are in operation are largely bearing this out is through ancillary services. So through frequency regulation, through spinning and non spinning reserves, but primarily through providing short bursts of power over short periods of time. They're great at that. Lithium ion batteries in particular are great at that, but they're not super energy dense. Right. So they're not able to shift large amounts of energy, which is where something like pump storage, hydro comes in. That's a technology that's been around since then, I think like the 1920s, right? It's been around forever, but it's extremely geographically constrained. So you can't just put a hydro plant with a reservoir anywhere you want. You need a height differential. You need, you know, there's all kinds of permitting hurdles, and they're extremely expensive projects. So as we think about how we are going to meet the grid requirements? And I think different organizations like Microsoft are becoming microcosms of this drive towards 100% renewable grids. They're managing that. Microsoft is managing that position as if they were a utility trying to be 100% renewable. They have demand in multiple different regions. They have multiple different sources of renewable supply, virtual as it may be, through ppas. And they're trying to align that. I mean, batteries are going to be absolutely essential, because without some sort of battery, or more broadly, energy storage, you would have to so dramatically overbuild the renewables to meet demand, and you'd be curtailing 90% of the renewable energy that's being generated just to meet that demand. So it really becomes an efficiency problem. Right? We could meet demand with just wind, but we'd have to overbuild so far relative to that peak demand in the hours where the wind isn't generating much. And so that's really where the energy storage comes into play. And when you broaden that beyond just the grid reliability, just beyond the megawatt hours, you start to think of those other attributes as well. Robert's point is really interesting, which is what are the regulations going to be around? How is the industry going to really think about the rec component? Because if the battery is charging from the grid, is it actually shifting the wreck from the solar? Does it have any value in shifting a wreck? And if we start to see hourly wreck markets, how are we going to be able to produce wrecks in hours where solar might not be generating? So I think there's a lot of open questions as we start to see the value of batteries and other storage technologies. But the benefit there is their flexibility. So they can contribute in many different ways to different objective functions, if you will, when it comes to portfolio management. So I think they're going to be critical. But I've heard an underlying theme is we're still working this out, and I think that that's true across everyone that we work with today that has batteries in their pockets.

Howard Walper, CEO, Americas at Commodities People

Great. And we're going to get audience questions in just a moment. So I want to remind everybody that if you do have a question, please put it in the q and a box, not the chat box, but in the q and a box so that our folks can see it on this end and we can queue it up for you. But one more comment on batteries. Robert and Brock in particular, what's really changed in this last year regarding how the industry is, is viewing batteries. It seems to be a rapidly moving part of the business.

Robert Harding – Energy Storage Business Development, National Grid Renewables

It is rapidly moving, Howard. We've got a lot more batteries online, for one, every year. It seems to be an exponential increase, which means a lot more people are getting comfortable with the technology and the operations and even the contracting around batteries. I think that's going to spill over into how market makers are writing the rules. And we're seeing that in legislative sessions, we're seeing that in RTO policy guides around, around the country here. The other big piece of batteries is that they've become a lot more affordable over the last year. The COVID supply chain really precluded a lot of the supply. It was a challenging situation for a while, and that seems to have cleared. So it's a good time for batteries right now.

Howard Walper, CEO, Americas at Commodities People

Great. Brock, did you have anything else to say about that?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Yeah, I'll just echo. We work with, again, a broad variety of different clients. But what we've seen mainly over the last year or two is that, as Robert said, a lot of these projects are now online. A couple of years ago, they were hypothetical. We were forecasting, we were predicting what was going to happen. We were trying to do scenario analysis to identify operational strategies that would be successful. But it was all forward looking and there were no backward looking results to use to cross check and verify and validate some of that analysis. Now we have a much richer data set. We have realized performance that we can look at, and we can see how these batteries are actually impacting the bottom lines of portfolios and how they're contributing to attribute matching and energy matching and financial risk management. And so it's real now, right? I think that's probably the biggest difference between the last couple of years is that these assets are finally online and they're contributing, and that's where we're going to see this kind of rapid evolution in terms of finding new use cases.

Howard Walper, CEO, Americas at Commodities People

Excellent. Well, at this point we have some time to take some questions from the audience and these are a few that have come in the course. And of course, please submit any questions you have through the q and a box. Get to as many as we can. What is the value of relatively flat load profiles and load dispatch abilities associated with data center operations? And open question, who'd like to jump in on that one first?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

I think I've talked about this a bit already, but yeah, like our data center load as I mentioned, is fairly flat. So just having that dispatchable feature in our contracts is very useful. But as we touched on, batteries are kind of in its infancy as far as PPA contracts go. So currently we don't think we have any battery contracts in our portfolio at the moment, but it would serve a very useful product for us in order to meet that flat load on an hour by hour basis. You know, I forgot what was going on next thought, so I'll just turn.

Robert Harding – Energy Storage Business Development, National Grid Renewables

Over to, from my perspective, Chris, you know, flat load is not a benefit that from a renewables person with short duration batteries, flat load is really hard to manage. Give me a load that looks exactly like a solar shape. That's easy. So that's actually one of the challenges, I think, of the flat load.

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah, that kind of reminded me where I was going with this. So like, you know, from our perspective, like the renewable assets, any battery storage that we look at, it all serves multiple purposes, right? So like our cash flow risk, our hourly attribute tracking, all that stuff kind of feeds into the calculus of whether or not, you know, we go after a particular project or contract. So like, you know, there's kind of this optimization problem that happens every time we look at a thing like, does this match our yearly goals, this match our hourly goal? Is this co located in a market that would offset some of our load short position. So all that kind of feeds together. So yeah, having a flat block, that's one piece of it, but maybe that's offset by that really messing up our cash flow risk in the particular region that we would cite that in. So it all feeds in together. So again, this whole portfolio analysis looks really like it helps us spread that out a bit.

Howard Walper, CEO, Americas at Commodities People

Excellent. We have another question. Come in. And again, it's related. AI infrastructure is a primary driver for the forecasted load increases and renewable energy build out. Do we think this is a sustainable trend? And what are some of the portfolio risk effects for individual companies? Maybe Chris would want to jump on that one as well.

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Yeah, yeah, I'll start on this. The forecasted AI growth is pretty staggering, to be frank. And the real problem that we see that we lose sleepover is that we have all of this huge load growth forecasted. Meanwhile, we're signing PPA deals that are 1520 years in tenure off of that forecasted low growth. So I think that for us the real risk is what if the AI load growth doesn't come through? What if GPU has become exceptionally more energy efficient in the future and were not anticipating that, then we would be on the hook essentially for a bunch of renewables that we don't have the load to offset. That's a big risk for us. But more broadly speaking, yes, a huge amount of load growth on the grid. Citing those is becoming increasingly a primary concern for where data centers get cited. Right, because citing a data center is an optimization of where it's located based on latency concerns, geographic concerns. But as more and more data centers get built around the world, increasingly energy is the first and foremost concern of like, hey, does the grid have the capacity to site this particular data center in this region? So, yeah, lots of, lots of challenges there.

Howard Walper, CEO, Americas at Commodities People

Wonderful. Well, I think it's going to be. We're going to have to cut that topic right there. We're almost out of time. I'd like to ask each of the panellists, as we're wrapping up this conversation, if each of the panellists could say maybe one thing to the audience to take away about building portfolios for the energy transition, what would it be? So who'd like to take that one first?

Brock Mosovsky, PhD – Co-Founder & VP of Analytics, cQuant.io

Maybe I can start here, like kind of kick us off. So, you know, I think that, I think the biggest takeaway is the idea that portfolios behave differently than just the sum of all the different components. Right. And they require a different framework of analysis. And, and I think that that's, we've seen a shift in how organizations are thinking about managing their portfolios to do exactly that. And I think that that's moving us in the right direction. And so what I would encourage the audience to take away is that there are strategies for success that are out there. They require maybe a little bit of a different form of management compared to what we've done over the last 15 to 20 years, but there are strategies for success, there are solutions, and we can get there.

Howard Walper, CEO, Americas at Commodities People

Great. How about Roger?

Roger Tabet – Senior Principal – Quantitative Risk Analyst, Portland General Electric

I would say the key takeaway is that we can more or less only build renewables now, more or less. It's not exactly that. And they have other challenges that we've been talking about and that everybody knows. And then you do need to know where you're risking what really, so you can, of course, simulate and see where you're missing reliability or where you're at risk of losing too much money, or on the long term if you're at risk of not meeting your carbon or emissions joules. And for that, of course, if you can find a way to simulate everything together, which is what silk one does, of course, that helps a lot.

Howard Walper, CEO, Americas at Commodities People

Excellent. Chris, final thoughts?

Chris Uberti – Energy Risk Analytics – Program Manager, Microsoft

Cquat's an invaluable tool for us, but I think more broadly, for us, diversification of technology is really a key player in meeting all of our goals and helping our portfolio, whether it be wind, solar battery storage, hydro storage. We have to use all of the tools in the toolbox to meet our goals. And even more broadly, in just this general energy transition, I think that's the strategy that, you know, seems to be what we have to do here. So, anything and everything is on the table.

Howard Walper, CEO, Americas at Commodities People

And thank you.

Robert Harding – Energy Storage Business Development, National Grid Renewables

And finally, Robert, I would say that these quant methods are, they're not new, actually, they're new to folks like my company that are coming from a place of specialties and land development and acquisition and contracting. But these quantitative methods are well known and are custom softwares in banks and energy majors and trading shops. And you could pick up a bunch of books, which I did do, and read them and try to do it yourself. But what cquant really does here is they help you manage your portfolio using quant level software without being a full quant yourself. And so that's where I've certainly seen value and taken comfort that it feels like the cutting edge sometimes because it is for the renewables folks. But really, we're just repurposing a lot of great math and stuff that's already been done and Brock and David have made it accessible for us.

Howard Walper, CEO, Americas at Commodities People

Wonderful. Well, folks, thanks for a great discussion today. It's been a pleasure to be your moderator this morning, and thanks for such great insights. And with that, it's a pleasure to turn the floor back over to David to take us home. David, the floor is yours.

David Leevan

Well, thank you, Howard. And thanks to commodities people for putting on this wonderful webinar. Many thanks to the panellists for all of the compliments for cQuant. That was unexpected, and we do appreciate it. So we're going to wrap up the q and a that brings us to the end of our time here together. Just a reminder that this webinar will be posted on the cQuant website probably next week. If you want to do something today to make sure you get access to it, you can go to infrequent IO and just send us a reminder to send you the link to the webinar. We'd be happy to do that. And thank you again for your attention today. We love serving the energy industry, and we're very pleased to be in a position to do what we do for you all. Thank you very much, and we'll see you next time. Thank you.

Written by: Commodities People

Analytics Energy Transition Renewable Energy Risk Management

labelAll Posts todayMarch 21, 2024

Experts discuss the essentials of surveillance setups amid increased scrutiny, implementing algo trading monitoring, the potential for mandatory surveillance in balancing markets, and share best practices from exchange market monitoring.

labelAll Posts todayMay 15, 2024

Ohio’s net metering program allows you to get credits for surplus energy you produce, which you can apply to future utility bills. The post Ohio Net Metering appeared first on [Read More]

According to the Database of State Incentives for Renewable Energy (DSIRE), Illinois’s net metering policy requires that customers who produce electricity using clean power can take advantage of net metering. [Read More]

The world is getting warmer. Scientists and climate experts say this is because of too many greenhouse gases (GHG) in the air, such as carbon dioxide and methane. These gases [Read More]

Energy systems are becoming smarter and more connected. But with new technology comes new risks. One of the biggest concerns is cybersecurity in energy systems. This means keeping energy infrastructure [Read More]

Understanding energy laws and their impact on energy can help you better comprehend how they affect you and your energy needs. Below, we outline how lawmakers, regulators, and courts steer [Read More]

RSS Error: A feed could not be found at `https://www.energyvoice.com/feed`; the status code is `403` and content-type is `text/html; charset=UTF-8`

Information on energy prices from July 2025, including a breakdown of rates and charges for every region on Flexible Octopus. [Read More]

Get rewarded using energy when the grid is green with Octopus Energy Turn Up Sessions. Instead of wasting all that clean energy, we’d like you to use it up instead. [Read More]

You can make a profit on your electricity bill on the Intelligent Octopus Flux tariff, or save around 90% with Fixed Outgoing. We dig into how saving with solar really [Read More]

Zero Bills Global Standard [Read More]

How zonal pricing could wipe millions off the electricity bills of businesses in critical industrial sectors, including steel, chemicals, car manufacturing, and data. [Read More]

Egypt gets its first large integrated solar PV and battery storage plant — a 1.1 GW solar PV plant with integrated 200 MWh battery will deliver dispatchable clean energy, enhance [Read More]

In the wake of the International Maritime Organization’s vote to price carbon in shipping fuels, I had the opportunity to sit down with an insider and expert on maritime decarbonization, [Read More]

Some companies use the word “eco” in their product names to try to fool buyers into believing their products are good for the environment, or at least, not bad. In [Read More]

It’s Independence Day here in the United States, which commemorates the ratification of the Declaration of Independence (from England) in 1776. What proceeded was millions upon millions — sorry, hundreds [Read More]

Following up on my report on BYD’s car, SUV, and pickup truck sales in June, let’s also have a look at its commercial vehicle sales. The company breaks out electric [Read More]

After years of setbacks, the UK is finally pushing ahead with two carbon capture and storage projects. While there is scepticism about the technology, says Ros Taylor, its supporters argue [Read More]

In 2019, the EU set into motion dedicated legislation to expand renewable energy communities (RECs) where they already exist, and enable citizen energy in countries – mostly eastern and southern [Read More]

Peatlands[1] account for 3% of the world’s land surface. As long as they are intact, they store large quantities of carbon dioxide (CO₂), one of the greenhouse gases (GHG) accelerating [Read More]

The EU promised a renewable energy future – but is it still on track? As political shifts, policy delays and legal battles unfold, the energy transition faces new hurdles. Are [Read More]

On 9 April 2025, Germany’s incoming government of Christian Democrats (CDU/CSU) and Social Democrats (SPD) concluded a governing ‘contract’ that paves the way for the partners to take office in [Read More]

The House version of Donald Trump’s “Big Beautiful” budget bill almost completely repeals the provisions of Joe Biden’s signature Inflation Reduction Act (IRA). In particular, the tax credits for homeowners [Read More]

By Tom Konrad, Ph.D., CFA Supply and Demand One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, [Read More]

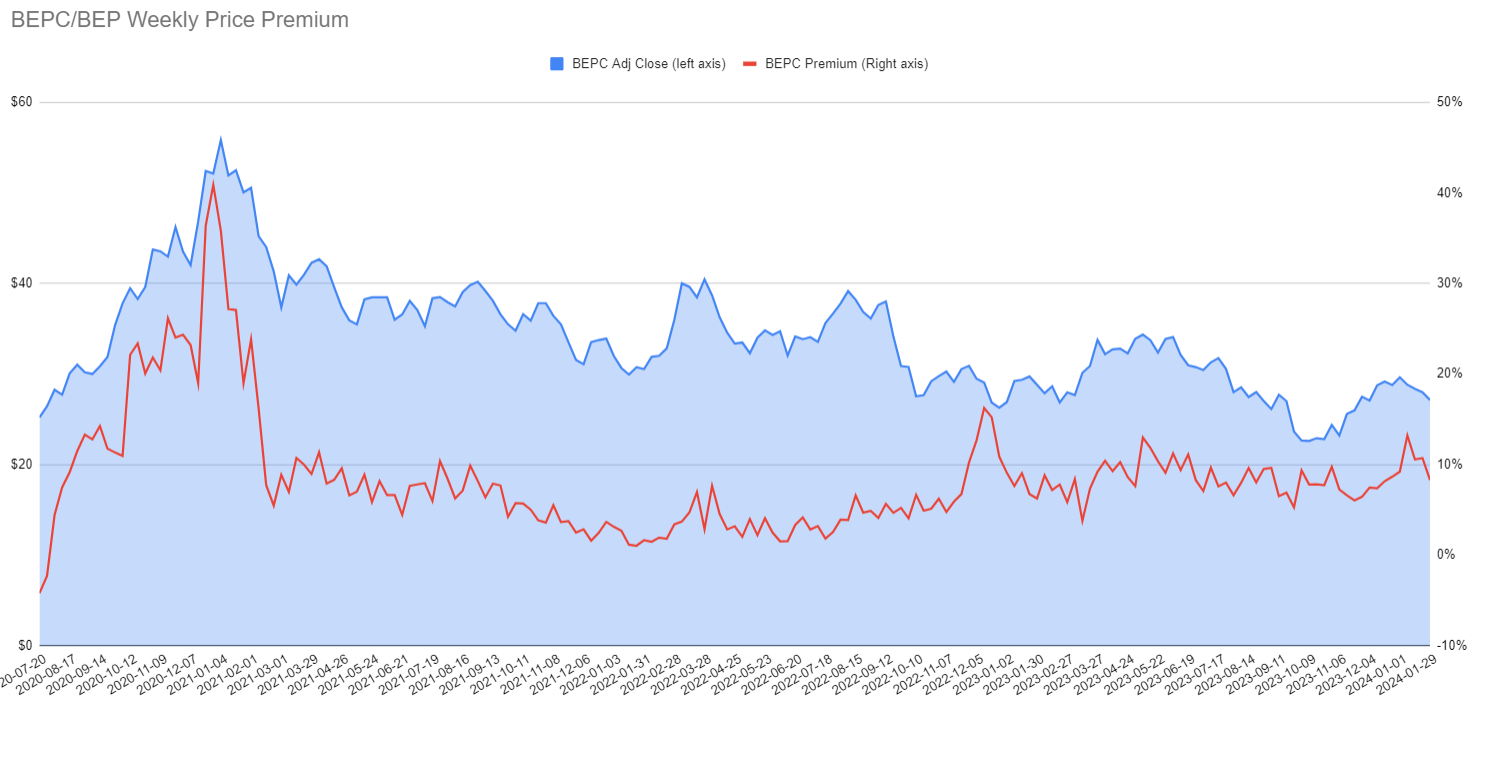

By Tom Konrad, Ph.D., CFA On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. [Read More]

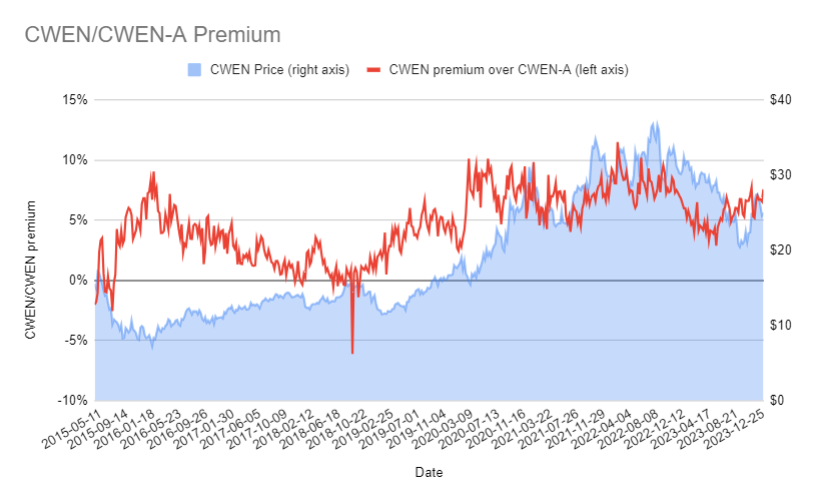

By Tom Konrad, Ph.D., CFA A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A [Read More]

By Tom Konrad Ph.D., CFA Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. [Read More]

With the heat of summer blazing across the United States, you’ve probably given some thought on how to cool down. One appliance that could help is the humble air-source heat [Read More]

With Memorial Day weekend now in the rearview mirror, summer is “unofficially” here. But before the hottest weather of the year rolls in, there’s still plenty of time to make [Read More]

In an era of rising energy costs and growing concerns about grid reliability, power companies around the country are offering demand response programs to help consumers manage electricity use while [Read More]

As springtime rolls in, the season of rejuvenation extends beyond gardens and closets – it’s the perfect time to make changes that can improve how you use energy at home. [Read More]

Thinking about making the switch to an electric vehicle (EV) but unsure where to start? You're not alone. The rapid rise in EV popularity has many consumers considering a move [Read More]

The race is on. Accenture explains why US energy companies will soon be fighting to be methane-mitigation pacesetters. [Read More]

A review of energy sector M&A approaches over the past decade sheds light on four inorganic growth pathways energy companies should consider. [Read More]

Accenture and the World Economic Forum identify five actions to get industries on track for net zero. [Read More]

Accenture identifies three IT enablers of innovation that upstream operators should develop or strengthen to remodel technology. [Read More]

Learn about the six key insights into why—and how—the energy transition must be accelerated. [Read More]

The amount of clean, homegrown energy from onshore wind is set to accelerate over the second half of the decade as the government launches the first ever onshore wind strategy. [Read More]

Aneo has entered into an agreement with KGAL Investment Management to acquire the Bäckhammar wind farm, located in Kristinehamn municipality in southern Sweden. [Read More]

Minesto is heading a consortium that has been awarded a total of SEK 25 million grant funding from Swedish Energy Agency to build a complete microgrid installation in the Faroe [Read More]

DEME has celebrated the launch of its second wind turbine installation vessel, Norse Energi, at the Yantai CIMC Raffles Offshore Ltd. [Read More]

Orica has been conditionally awarded AUS$432 million in ARENA Hydrogen Headstart funding to support the operation of the Hunter Valley Hydrogen Hub. [Read More]

Copyright 2023 Commodities People

MOLECULE

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

MOLECULE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

cQuant.io

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

CAPSPIRE

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

CAPSPIRE

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

DIGITERRE

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

DIGITERRE

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

EMSYSVPP

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

EMSYSVPP

GOLD SPONSOR

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

ENERGY & METEO SYSTEMS

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

ENERGY & METEO SYSTEMS

GOLD SPONSOR

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

FIS

GOLD SPONSOR

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

deltaconX