todayOctober 4, 2021

All Posts Commodities People

todaySeptember 5, 2023 300

Ben Hillary, the Managing Director of Commodities People, interviewed David Leevan, the CEO of cQuant.io, a leading player in advanced energy and commodity analytics models. The discussion covered a wide range of topics, including the ongoing clean energy transition, the importance of model risk, the evolution of analytics, and what the future holds for cQuant.io.

The Clean Energy Transition

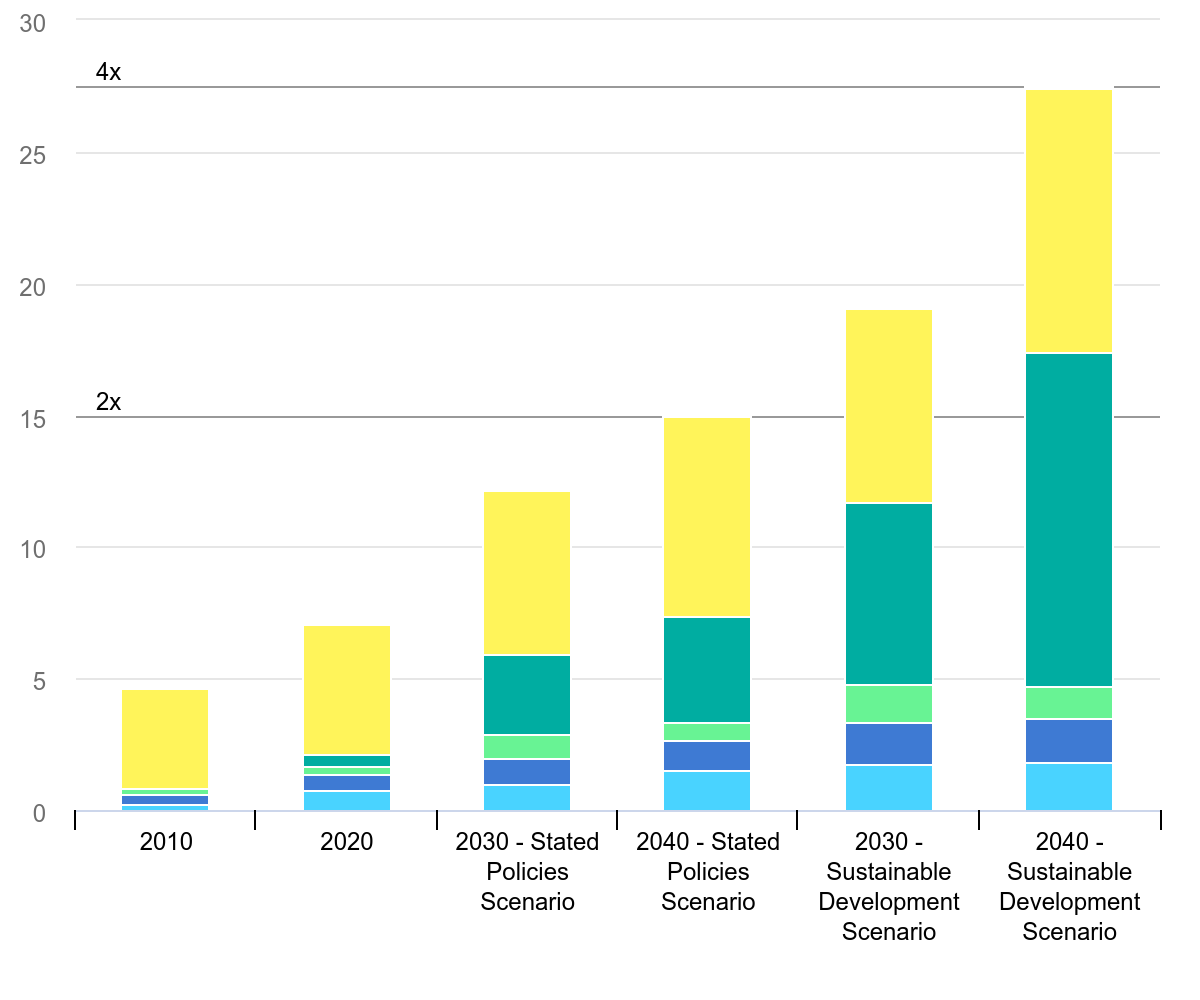

David noted that skepticism about renewable energy integration into power grids has largely vanished. Companies traditionally not focused on energy, like Amazon and Microsoft, now have significant energy portfolios, highlighting a seismic shift in the industry.

The Role of Analytics in Energy Transition

cQuant.io is benefiting from this clean energy transition by providing analytics that help manage the complexities introduced by renewables and battery storage. These analytics also help companies forecast the performance of diversified energy portfolios.

Model Risk and Analytics Infrastructure

David stressed the importance of understanding the robustness of analytic models. He mentioned that both vended and internally built analytic solutions come with risks and suggested a best practice: use internal quantitative teams to manage and validate external vended models.

Scenarios vs Simulations

He emphasized the difference between traditional scenario analysis and more advanced simulation frameworks. Simulations offer more robust and complex insights as they consider multiple variables and their relationships in a stochastic environment.

Future of cQuant.io

The company aims to make portfolio management easier with cloud-native solutions and excellent customer service. New products and data generated by their models will also be offered, and they're exploring the integration of AI and ML into traditional modeling frameworks. Additionally, cQuant.io is working on real-time analytics and expanding its global presence.

cQuant.io will feature in Energy Trading Weeks in London and Houston, providing case studies and panel discussions on subjects like forecasting and optimization, managing risk around renewable assets, and more.

This interview not only showcased the remarkable progress cQuant.io has made but also provided valuable insights into the evolving landscape of energy analytics.

Watch below:

Ben Hillary

Hello everyone and welcome. My name is Ben Hillary, managing Director of Commodities People. And I'm absolutely delighted to be joined here today by Dave Levan, CEO of Sequant. I'm personally a huge fan of Sequant and everything they do. It really feels like right now they are setting the field in the area, setting the pace in the field of advanced energy and commodity analytics models and forecasting and yeah, absolutely do have the results to prove it. So Dave, welcome.

Dave Levan

Thank you Ben. I appreciate being here.

Ben Hillary

It's a pleasure. Well, first question from where you sit, how have you seen the energy sector evolve in recent years? What's been most striking to you?

Dave Levan

I think the obvious answer is the clean energy transition. Right. I think we're all in the midst of experiencing that. When I first entered the energy industry at about the year 2000 and probably for ten or twelve years after that, I think most of the voices were, this is never going to work. You're never going to get renewables at a certain level to work on our power grids. You're not going to be able to store the energy. And I think really you don't hear much of that anymore. We are well down the road into our clean energy transition. Obviously there are bumps along the way when you make these kinds of transitions but that is really the overriding macro changes that are happening inside of the energy industry and it's really affecting commodities as well. Beyond that, I would say that the advent of a brand new set of market participants. When you see folks like Microsoft and Walmart and Amazon and Ford and GM and BASF and all of these traditional corporate entities, that really energy was simply a line item in their overall budget and it probably never rose to the level of management decision making. And suddenly those entities have very large energy portfolios that they're managing themselves. I think all of those type of market entrants really are coming into our industry and changing the way discussions are being had. And then I would say, lastly, what comes to mind Ben, is that probably a little bit more close to home is the rise of cloud native solutions. Again, when I first started in the energy industry, most people didn't want to hear about cloud native solutions. And now if you're not choosing a cloud native solution, I think somebody's going to come and knock on your door and saying, why are we putting this behind our firewall? Why are we spending millions of dollars to manage this when somebody else could be managing it for us?

Ben Hillary

Very interesting. Cloud was such a dirty word for such a long time. Even now we run some surveys and I'm always quite staggered by the sort of volume of people who still have their reservations and concerns. It's fascinating. Well, Sequant as a company seems to have really grown considerably in the last few years. What's really driving the growth?

Dave Levan

Well, I'll go back to the macro answer from the previous question. Right, so we happen to be sitting right in the middle of the river of this clean energy transition from an analytics perspective. So we, when so many new companies are coming that are either 100% renewable or renewable plus battery storage, or just battery storage, that presents its own set of problems. But I think by far the most complex challenges that are faced inside of the energy industry is companies that are in transition more traditional sources of energy, and they're starting to incorporate clean energy technologies, clean energy contracts, renewable generation, battery storages into their portfolio mix. And that's both a real challenge. The rise of those technologies is both a real challenge for those that operate our grids, but also for folks that are trying to manage their own portfolio and forecast how their portfolio is going to perform. Given the intermittent nature of wind and the sun shining and the complexity of the contracts, example, renewable, PPAs, all of these things are adding so much complexity into the portfolios of our customers that they really require better insight into what's driving the value, and really more importantly, Ben, what's driving the uncertainty and value into their portfolio. And so if you're an executive team and you want to manage the portfolio in the most optimal way, you need an analytic infrastructure that can handle all sorts of different types of assets and contracts and then really calculate how that portfolio is likely to perform and then probably most importantly, how to improve the performance of that portfolio. So the energy transition, again, is creating lots of changes for energy companies, and thankfully, Sequant seems to be kind of well positioned to take advantage of that.

Ben Hillary

Excellent. We've had a few interesting conversations recently, and one of the areas we've spoken about is around model risk. So from your perspective, why should energy and commodity firms be focused on model risk? What is there for them to fear from, bespoke or vended analytic solutions?

Dave Levan

Well, I hate to be a fear monger, but I think this is an important subject. So the question really is, if you're running an energy portfolio, whether you're using a vended analytic infrastructure, or you have some internal teams building analytic models, how do you know really what's in those models? I don't think vendors are absolved from this, nor do I think internal teams are absolved from this. Right? So we've all seen a number of companies go bankrupt or disappear altogether over the last four or five years. And Ben, all of them had analytics. They all had analytics. So the question is, what went wrong? Right? Were the analytics perfect and the management team wasn't fully utilizing them? Were the analytics sort of too niche and not enough about the portfolio performance? A lot of companies still use risk management reporting out of their deal capture platforms, and so they get their VAR and they feel like that box has been checked. And then all of a sudden somebody has a very substantial loss, a very big boo boo, and suddenly that company is going bankrupt, right? So the question is, at a macro level, I think the question is, do companies really know what is going on in the analytic infrastructure? Should they get some outside advice from maybe a major consultancy to come in and review the analytic infrastructure? Right? If they ask me to come in and review the analytic infrastructure, everybody knows we want to place sequent solutions there. So maybe you should go get a third party, right? And then if you have your internal team building all of your solutions, are they really going to self diagnose shortcuts that they're taking? In our opinion, when we see the best practice, what we see is internal quantitative teams managing and validating external vended models because that is where you are utilizing human nature to make sure that the enterprise is safe, right? So all quants like to poke at other quantitative models. So if you have Sequant in there, nothing will make your quantitative team happier than finding an edge case that Sequant hadn't thought about before. We love that because then we get to expand the robustness and the scope of our models and then all of our customers get to enjoy that uplift in capability. And so of course we're coming from one perspective on this, but I think the best practice is to go get a vended analytic infrastructure and have really good internal quantitative teams that are validating and testing that outside infrastructure to make sure it's doing what it's supposed to do.

Ben Hillary

Yeah, excellent. Well, in line with that theme, is there a difference between scenarios and simulations? And I suppose, why does it matter?

Dave Levan

Big differences. I think a lot of people still use straightforward scenario analysis because that's been done in the commodity and energy space for 30 plus years, 50 plus years, whatever the case may be. Let's define terms a little bit. So your scenario analysis traditionally would be, hey, listen, I've got a base case scenario, I've got a deterministic forecast of price or whatever it is. Given that deterministic forecast, I think my portfolio is going to have this result or my asset or my contract is going to yield this result. And then somebody comes by and says, hey, you should really run a couple of scenarios on that. And so maybe you move the price of natural gas up by a dollar or down by a dollar, or maybe you move the forecasted power price, or maybe you move the weather forecast a little bit. But these become one off adjustments to a deterministic base case scenario. I think that was probably 20 years ago, that was probably the best way to do it. But with the rise of Monte Carlo simulation models and modeling frameworks, now it's possible that you can set up all of your risk factors. Okay, hold on. What's a risk factor? David? It's anything that drives value and uncertainty in value into your portfolio. Weather load, different commodity prices, ancillary services basis, relationships, interest rates, congestion. Right. All of these things in the marketplace actually pull on each other. And they're pulling on each other all the time. And they pull on each other differently in January than they do in July. They pull on each other differently on Mondays than they do on Saturdays in July or January. Right. So all of these risk factors are constantly pulling on each other. And in order to represent that in a model, you need to have a very robust simulation framework where you're simulating all of those relationships. And if you have power prices move this way or you have renewable generation move that way, it's moving every other risk factor in the entire framework all the way down to the hourly and sub hourly level going out. Ten years. 20 years. And you're doing thousands upon thousands of simulations and then optimizing and valuing your portfolio to all of those simulation paths. It becomes a really intense quantitative exercise to get those type of simulation frameworks done right. And so that's a first step. Again, what we think is the best practice is to do both. So you have your simulation framework where you're doing all of these thousands upon thousands of simulations, hourly and sub hourly out for many years, and then you go in and you say, okay, that's all well and good, but let's throw a couple of scenarios onto the simulations. Now let's move weather around, now let's move renewable generation around and see how it affects everything in the portfolio. So that's sort of the state of the art, is to actually incorporate both into your analysis.

Ben Hillary

Yeah. Excellent. With so much change, with so much going on, with so many opportunities.

Dave Levan

With.

Ben Hillary

The markets just evolving so rapidly, where do you see Sequant in three years from now? What's on the horizon for Sequant?

Dave Levan

That's a good question. So many things and a couple of things I probably can't mention, but what we're invested in at the top level is taking the friction out of an energy or commodity company's ability to manage their portfolio. So we're completely cloud native, right? So they can stand up in a matter of hours really instantaneously, and they can get their data into that platform in a matter of weeks. We've got really good customer service to help people along the way. So we're just trying to make this easier for people, and we're never going to stop doing that. But I think what you're going to see from Sequant is a plethora of new products coming out, and they're going to be model generated products, new data for the industry that's coming out of our models. We're going to productize some of that data and make it available. So there are people that may not want to use SQL, but may want to use our simulation data, for example. So those are the type of changes that we're thinking about. And then I think we believe there's a place for AI and ML in traditional modeling frameworks. But that's such a buzword today and I think, I personally think some people are going down the wrong path. You're not going to be talking to Siri and saying, siri optimized my portfolio and it's going to happen. Right. So there's a combination of traditional and new modeling techniques that we're working on and I think other people are working on them too. And so the industry should expect those combination of methodologies to be coming out over the next year or two from us. And then it's really, I would say, the speed of analytics. People have gotten used to Ben kicking off a run at 10:00 P.m. And being done by 04:00 A.m. And having all of your portfolio analytics during the day, done the night before. What we're seeing the marketplace demand is instantaneous analytics. So ongoing real time analytics that leverage all of the work that was done during the evening to constantly update reports. And I think that kind of real time analysis is where the energy industry is headed and certainly we're headed there. And then finally, what comes to mind is building our global presence. We're in every market in the United States and North America right now. As you know, we've been expanding our presence in Europe and we have some designs to expand globally as excellent, excellent.

Ben Hillary

And finally, at the upcoming energy trading weeks in London and Houston, sequant are going to be providing a number of really interesting case studies and panel discussions on a range of subjects including forecasting and optimization, analytic innovations for the transition, managing risk around renewable assets, and a number of other subjects. Could you provide, I suppose, a sneak peek of what you'll be covering?

Dave Levan

Sure, absolutely. At Sequant, we definitely like to put our analysts front and center. They're the ones that are either developing these models or conveying the importance of these certain methodologies to the. So, you know, we're lucky. In the London event at the end of September, we're going to have our director of analytics for Europe, Pierre Levon, doing both a panel and a more detailed presentation on forecasting and optimization methodologies, analytic innovations that we're working on, and where Sequant is pushing the envelope in terms of providing more and more useful tools to the energy industry. And then in October for the Energy Trading Week in Houston, we're going to have our VP of Analytics, Brock Mussowski, talking there about managing risk on renewable portfolios, but also portfolios that are in transition, bringing on more renewable portfolios. And increasingly we're being asked about hedge optimization and different contract structures and how to employ different contract structures to properly hedge complex portfolios. Brock will be spending a fair amount of time on those. I think, you know, we love working with commodities people. We think you guys have the best events in the energy and commodities space. Thank you. The particular subjects that our analysts are going to be presenting to your audience, hopefully they'll be very useful.

Ben Hillary

Yeah, no, that's excellent. I'm really looking forward to that. I always do enjoy Brock's presentations immensely. And yeah, look forward to hearing from Pierre also. No, that's brilliant. Well, that brings us to the end. So many thanks, David, for a fascinating conversation and yeah, I will look forward to seeing you on this side of the pond in September. And on your side of the pond in October.

Dave Levan

Thank you, Ben. Thank you.

Written by: Commodities People

Analytics Client Interview Data Risk

labelAll Posts todaySeptember 1, 2023

This important webinar brings together traders with technology and industry thought leaders to explore the latest best practises in data management. Our expert panel will explore how data lakes work [...]

labelAll Posts todayMay 15, 2024

Ohio’s net metering program allows you to get credits for surplus energy you produce, which you can apply to future utility bills. The post Ohio Net Metering appeared first on [Read More]

According to the Database of State Incentives for Renewable Energy (DSIRE), Illinois’s net metering policy requires that customers who produce electricity using clean power can take advantage of net metering. [Read More]

The world is getting warmer. Scientists and climate experts say this is because of too many greenhouse gases (GHG) in the air, such as carbon dioxide and methane. These gases [Read More]

Energy systems are becoming smarter and more connected. But with new technology comes new risks. One of the biggest concerns is cybersecurity in energy systems. This means keeping energy infrastructure [Read More]

Understanding energy laws and their impact on energy can help you better comprehend how they affect you and your energy needs. Below, we outline how lawmakers, regulators, and courts steer [Read More]

RSS Error: A feed could not be found at `https://www.energyvoice.com/feed`; the status code is `403` and content-type is `text/html; charset=UTF-8`

Information on energy prices from July 2025, including a breakdown of rates and charges for every region on Flexible Octopus. [Read More]

Get rewarded using energy when the grid is green with Octopus Energy Turn Up Sessions. Instead of wasting all that clean energy, we’d like you to use it up instead. [Read More]

You can make a profit on your electricity bill on the Intelligent Octopus Flux tariff, or save around 90% with Fixed Outgoing. We dig into how saving with solar really [Read More]

Zero Bills Global Standard [Read More]

How zonal pricing could wipe millions off the electricity bills of businesses in critical industrial sectors, including steel, chemicals, car manufacturing, and data. [Read More]

Augwind Energy, based in Israel, will build the “world’s first commercial-scale AirBattery system” in Germany. The battery will use compressed air stored in salt caverns to generate electricity. The AirBattery [Read More]

Trump pulled the DOGE Card on Elon Musk in an early morning social media blast, after the Tesla CEO threatened to tank Trump's "Big, Beautiful" tax bill and start his [Read More]

Global automotive leader drives innovation with award-winning EV and hybrid vehicles while expanding electrified portfolio and advanced manufacturing technologies Hyundai Motor Group (the Group) has been recognized by TIME magazine [Read More]

Key Process Improvements Save Energy and Cut Costs for Recycling Polyester With Enzymes A successful collaboration involving a trio of research institutions has yielded a road map toward an economically viable [Read More]

U.S. Department of Energy’s Energy to Communities Program Helped Edgartown, Massachusetts, Plan for a Microgrid To Support Municipal Buildings in Emergencies There is no bridge to the island of Martha’s [Read More]

After years of setbacks, the UK is finally pushing ahead with two carbon capture and storage projects. While there is scepticism about the technology, says Ros Taylor, its supporters argue [Read More]

In 2019, the EU set into motion dedicated legislation to expand renewable energy communities (RECs) where they already exist, and enable citizen energy in countries – mostly eastern and southern [Read More]

Peatlands[1] account for 3% of the world’s land surface. As long as they are intact, they store large quantities of carbon dioxide (CO₂), one of the greenhouse gases (GHG) accelerating [Read More]

The EU promised a renewable energy future – but is it still on track? As political shifts, policy delays and legal battles unfold, the energy transition faces new hurdles. Are [Read More]

On 9 April 2025, Germany’s incoming government of Christian Democrats (CDU/CSU) and Social Democrats (SPD) concluded a governing ‘contract’ that paves the way for the partners to take office in [Read More]

The House version of Donald Trump’s “Big Beautiful” budget bill almost completely repeals the provisions of Joe Biden’s signature Inflation Reduction Act (IRA). In particular, the tax credits for homeowners [Read More]

By Tom Konrad, Ph.D., CFA Supply and Demand One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, [Read More]

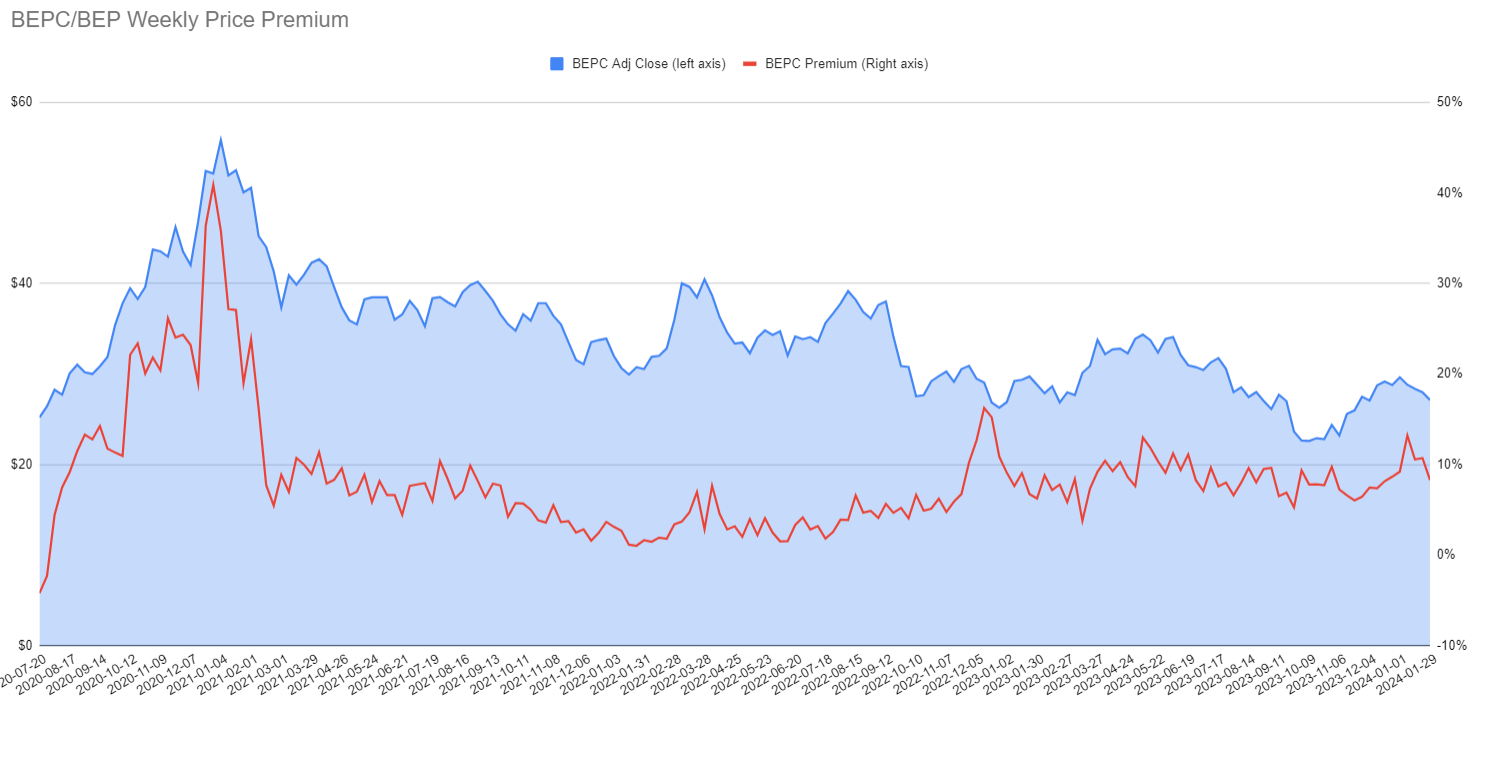

By Tom Konrad, Ph.D., CFA On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. [Read More]

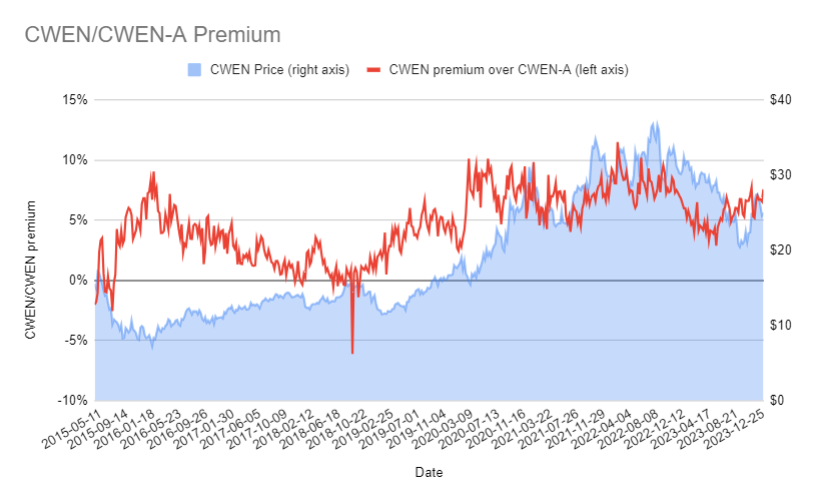

By Tom Konrad, Ph.D., CFA A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A [Read More]

By Tom Konrad Ph.D., CFA Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. [Read More]

With the heat of summer blazing across the United States, you’ve probably given some thought on how to cool down. One appliance that could help is the humble air-source heat [Read More]

With Memorial Day weekend now in the rearview mirror, summer is “unofficially” here. But before the hottest weather of the year rolls in, there’s still plenty of time to make [Read More]

In an era of rising energy costs and growing concerns about grid reliability, power companies around the country are offering demand response programs to help consumers manage electricity use while [Read More]

As springtime rolls in, the season of rejuvenation extends beyond gardens and closets – it’s the perfect time to make changes that can improve how you use energy at home. [Read More]

Thinking about making the switch to an electric vehicle (EV) but unsure where to start? You're not alone. The rapid rise in EV popularity has many consumers considering a move [Read More]

The race is on. Accenture explains why US energy companies will soon be fighting to be methane-mitigation pacesetters. [Read More]

A review of energy sector M&A approaches over the past decade sheds light on four inorganic growth pathways energy companies should consider. [Read More]

Accenture and the World Economic Forum identify five actions to get industries on track for net zero. [Read More]

Accenture identifies three IT enablers of innovation that upstream operators should develop or strengthen to remodel technology. [Read More]

Learn about the six key insights into why—and how—the energy transition must be accelerated. [Read More]

Rolls-Royce has received a second order from Eureka Pumps AS to supply mtu Series 4000 engines to power emergency power generators for the Norfolk offshore wind farm on the east [Read More]

HyperStrong and Repono AB have signed a partnering agreement aimed at jointly advancing 1.4 GWh grid scale energy storage projects across Europe by 2027. [Read More]

Matrix Renewables and Pioneer Community Energy have signed a resource adequacy capacity contract that covers 22 MW of capacity from the Alamo battery energy storage project, located in Kern County, [Read More]

Dismantling processes have begun at Energiequelle GmbH’s Rekum repowering project in Germany. [Read More]

A standardised approach for quantifying the mechanical limits of subsea cables has been published by offshore wind industry leaders and the Carbon Trust, addressing uncertainty in the offshore industry on [Read More]

Copyright 2023 Commodities People

MOLECULE

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

MOLECULE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

cQuant.io

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

CAPSPIRE

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

CAPSPIRE

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

DIGITERRE

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

DIGITERRE

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

EMSYSVPP

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

EMSYSVPP

GOLD SPONSOR

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

ENERGY & METEO SYSTEMS

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

ENERGY & METEO SYSTEMS

GOLD SPONSOR

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

FIS

GOLD SPONSOR

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

deltaconX

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

deltaconX

GOLD SPONSOR

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

Energy Exemplar

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

Energy Exemplar

SPONSOR

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

REDEX

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

REDEX

SPONSOR

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

ENERGY TRADERS ASSOCIATION

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

ENERGY TRADERS ASSOCIATION

ASSOCIATION PARTNER

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

STA

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

STA

ASSOCIATION PARTNER

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

EUROPEAN ENERGY RETAILERS

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

EUROPEAN ENERGY RETAILERS

ASSOCIATION PARTNER

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

ENERGY TRADERS EUROPE

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

ENERGY TRADERS EUROPE

ASSOCIATION PARTNER

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

AIGET

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

AIGET

ASSOCIATION PARTNER

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

CTRMCENTER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

CTRMCENTER

GOLD MEDIA PARTNER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

TRADE FINANCE GLOBAL

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

TRADE FINANCE GLOBAL

MEDIA PARTNER

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

Post comments (0)