todayOctober 4, 2021

All Posts Commodities People

todaySeptember 14, 2023 430

In a riveting discussion hosted by Howard Walper from Commodities People, Sterling Carmen, CEO of Triarc Solutions, delves into the evolving landscape of ETRM technology. With over two decades in the industry, Sterling provides a unique perspective on the challenges customers face, the build vs. buy dilemma, and the direction in which ETRM tools are headed. As the commodity business continues to grow, how are ETRM tools adapting to the changing pace? Are they equipped to handle emerging products in the market? Sterling touches upon these questions and more, offering a glimpse into the future of ETRM systems.

For those keen on understanding the intricacies of ETRM technology and its future trajectory, this discussion promises valuable insights. Dive in to explore the challenges, solutions, and opportunities that lie ahead in the ETRM domain.

HOWARD WALPER

Hello everyone. My name is Howard Walper, and I'm with commodities people. Today I have the pleasure to be here with Sterling Carmean, who's the CEO of Triarc Solutions, a group that's focused on consulting, support, and staffing services solely focused on right angles. And he's been working with right angles personally for about two decades. Isn't that right, Sterling?

STERLING CARMEAN

Yes. Great.

HOWARD WALPER

Well, it's a pleasure to welcome you here today and be part of this interview. Today we're going to be talking a little bit about ETRM technology and how it's changing and how it's adapting to new types of business and the new speed of business. So why don't we kick things off with the question, what is the current state of the ETRM industry right now?

STERLING CARMEAN

Yeah, well, Howard, thanks for having me. Yeah, it's interesting, we are in an interesting moment right now. I think it's a bit of an unprecedented moment in comparison to where we've been over the last 1520 and 30 years. I'd say right now, all major platforms for CTRM ETRM are currently held by one vendor, which is interesting because that certainly removes a bit of the competitive activity between the larger platforms that we've seen in previous years and decades. So that's kind of what's happening on the vendor side, I think. On the commodity business side, industry continues to change and grow. Nothing on the commercial side has slowed. I think these customers and businesses are very much alive and flowing and need technological support from vendors around the space. So it's really a bit of an interesting moment that we find ourselves in right now.

HOWARD WALPER

And when it comes to technology, I guess one of the places to start really is with the customer. Right? So what are some of the challenges customers are facing right now in utilizing this type of system?

STERLING CARMEAN

Yeah, I think there are a few of them. I think that total cost of ownership is a major one. Certainly we all appreciate systems are expensive, but really wrapping your arms around the total cost of that can be really significant. When we look at It budgets for customers, I find this surprising, but initial implementations are still proving to be challenges. Sometimes it's not a 100% success rate, and certainly in those scenarios, you always have three groups kind of responsible for the success of a new implementation: the customer, the si, the system integrator, and the vendor. And so certainly from our perspective, a project doesn't go wrong without some kind of misbehaving of at least a couple of at least two of the three of those. So we're seeing those that's a little bit shocking that those continue to be challenging for some groups. We're not seeing a 100% success rate there. I'd also say that these systems are largely not intuitive and thus bringing one of these kinds of on board at your business can prove to be a challenge of training for employees. That's a difficult hurdle in some scenarios. These systems are also largely difficult to support. And I'd kind of say that it's challenging to see that. And we feel for customers when those moments happen. But I think we're seeing kind of lower vendor support, as I spoke about a minute ago, that once you kind of lose that competitive activity between different major providers, then suddenly support is one of those areas that can start to slow down, but also very much in house for businesses. I think it's difficult for them to find competent resources who they can hire in house because right now there is a tightly constrained resource market. From an employment standpoint, it's very difficult to find individuals. So I think that's tough. And I'd probably say that all in all, one of the kinds of final changes that customers face is that really these CTRM systems were not built with user experience as a focus. To say that is even a little light hearted as well, because years ago it was all about can you get transactions in? What kind of speed to market opportunities are going by, how can we capitalize on those from the vendor space in CTRM? But I think there's going to be a new focus in the next generation tools and in the years to come on really, that customer experience, user experience. It's hard that all of us have now lived more than a decade with a smartphone in our pocket and we'd say that most of those applications are nearly pretty in comparison to what we're seeing in CTRM ETRM. And I think we're going to see a push for those platforms to kind of have a bit of a facelift.

HOWARD WALPER

Now, are these ETRM tools positioned to support the change, the continuing change in the commodity trading business?

STERLING CARMEAN

Yeah, I think I would probably answer no to this one, that they're not and maybe not in the traditional ways that people would expect. So I think Etrms are really fantastic engines. They are, relatively speaking, stable platforms to work with. And I think a lot of people have even gone so far as to use the phrase that they're mature. And I'm not a big fan of that word. I think that makes us think of, oh man, this is a mature platform, no continued innovation is necessary. It is kind of what it is. Put that thing in park and we're good to go. I think I would prefer the word established platform. So established that we know what they do, they're doing it consistently. It's stable from that standpoint. But I don't think mature is quite right because I think there is a future opportunity here. I think there's a traditional expectation that I was speaking to a second ago that ETRM vendors will see the need from the market, understand it, make a change inside their platform, come out with whether that's features or specific components to meet those needs. And that they are the one stop shop for solutioning really within the market. And I think that's what it has been for a long time and I think that's been great. But again, I think the environment is moving away from that right now. And as we recognize that these are great engines, but in many ways they're also kind of large. These behemoth kinds of ships are very difficult to turn. Not saying it's not possible, just saying that it can take a little bit to do that. I think it's a wrong expectation that customers in the market may have today to expect that they would work in a pattern where a customer communicates a challenge to the vendor, vendor absorbs that, gets a little more feedback, then builds a feature that comes all the way back around to meet that customer need. I think the timeline that is possible to deliver that sequence is getting longer and longer. And so I think customers who aren't aware of this could be growing in frustration when really I think we've probably crossed the line that that's not really a reasonable expectation.

HOWARD WALPER

So if that's not a reasonable expectation, what are the solutions to these challenges?

STERLING CARMEAN

Yeah, I appreciate what I'm saying could sound like bad news, but this is kind of how markets change and shift over time. Certainly these are just the advancements and iterations that they go through. I think right now we're going to see an increasing responsibility on third parties and actually customers themselves to create complementary, and I sometimes call them satellite systems around these kind of monolithic CTRM engines. And I think we're already seeing that in recent years. It's becoming fairly common. Actually. I'll give one quick example of reporting. So we see people shifting from the reporting styles within these systems and it's very common to shift these things out to tableau power, Bi, Excel, all sorts of things. And that's pretty common from kind of trading shop to trading shop. So that is almost an expected component of an initial implementation these days. So I think that is going to gain ground for the customers who are tech savvy. I think we're going to see them starting to realize that they can meet their own needs. Got you. So it'll just be interesting to see how that goes. But I also think that the question is how is it that customers and third parties can provide these satellite systems? Well, this is going to put pressure on a topic that I've talked about before, but is interoperability. And so this concept basically means the ability of a system to speak very quickly and readily with many other systems within its ecosystem in the right angle space. I would speak to that. I think this has been a massive success by the vendor to create quite literally hundreds of open APIs. What is the interoperability grade that I would give to that platform? I'd probably give it an A plus at this point. And so it's very open and they are cooperating with those sorts of ideas and saying, yes, we want our data to be accessible to other systems and we want to be able to bring data in and out from other systems as well. I think we're going to see increasing pressure for these major systems to have very open front doors and side doors, back doors, all these things. We need lots of APIs really to put it in kind of straight tech speak. So I think that'll be a big component of the future.

HOWARD WALPER

Excellent. Well, let's take a little shift here. I think a lot of companies are looking for the perfect system, maybe not seeing something that suits their needs and deciding to build their own. So we have this build versus buy question out there when it comes to systems. When a company is looking at this option, build versus buy, maybe what should they be considering?

STERLING CARMEAN

Yeah, I've spent time interestingly on all three of the sides of one hand, I've worked with a vendor and been part of a software creation and delivery team. I've worked on the client side, having to receive that software, having to deal with the kind of constant advancements of the business and from an It standpoint, trying to keep up with them. And I've worked on the consulting side to try to bring both a vendor product and a customer need to be able to bridge those things together with solutions. This is an interesting question to me. I actually think that it's really a question of the mentality and what is the culture of that customer, that organization, in order to decide, are you prepared to build or buy? And I would say maybe a question I would ask, just a summary statement would be if someone's watching this thinking should we build or buy? I think I would ask the question, do you want to be a software creator or a customer? And let's kind of describe what those two worlds look like a little bit. So in the world of a software creator, I love technology and so I don't mind being a technology guy because I enjoy it. But I can appreciate it, not everyone does. And so you're going to need to either be a deep technology individual or have a culture of that where you as an organization, your organization sees a competitive advantage to the technologies that you all utilize. So if you're looking around your shop and thinking, man, I can point to a couple of examples where we were bleeding edge, then maybe you do have a culture of kind of rapid technology adoption. You're interested in staying on the forefront. So then let's evaluate the world of a customer. The world of a customer is focused on finding their advancement and their advantage, I should say, in their business is perhaps more on a commercial side and they don't see the value of the investment from a creator standpoint, that would necessitate that. So they just want to if somebody just needs to help me we joke all the time that we use plumbing as an example. It's like I just need somebody to come in and help me put in this faucet. Please. I just need that faucet to work. It just needs to be there. I have other things to do in the house, but the faucet is not my focus. I just need to get that thing working. So if that's a little bit more of your culture, your narrative, I think that probably a customer worldview would be an appropriate one. And I will say certainly we could probably talk about that question for 15 or 20 minutes. There's a lot to dig into there and it's been done successfully. Both sides have been successful in the past and frankly, both sides have struggled in the past. So it's not like, hey, I just want the 100% success path. Tell me whichever one of those it is. It's certainly more nuanced than that.

HOWARD WALPER

There's a really good answer to that question and I've asked that question many times to many people. So thank you for that. There's a lot of newish, I guess, products out there. Things like LCFS products, PPAs, virtual PPAs, and a lot more LNG out there. First of all, is the average ETRM able to handle those products? And really, is there an all in one solution out there or should people be looking at several different technologies and if so, how do you harmonize these technologies? Which I guess relates back to what you were saying about a lot of APIs, but I'd love your perspective on this.

STERLING CARMEAN

Yeah, this is a great question. I actually feel like this is probably one of the hardest things for new customers to come to. The knowledge of this is very similar to you are completely as a customer entering a new space. Oftentimes there are very few circumstances where people have very few customer to customer relationships where they can talk about, well, what technology do you use, how is that working for you? It is very challenging to get down to the bottom of what is right for them. I think there are a few components that make this hard and then we can talk about how you overcome those components or those challenges. So one component that makes this very difficult is that often, historically, when someone says, hey, I run in this sort of commodity space. I do AGS or I do liquids, energy, or I do gas or whatever it is, and they say, well, I want to put out an RFP for this, or something like that, unfortunately, which it's the salespeople's job, I get it. But unfortunately, a variety of platforms will respond to that. And the real truth of the matter is there is actually not all that much overlap between different systems. And yes, there are some. And these certain markets and things, it's very rare that you will see a legitimate kind of head to head battle of a system who is attempting to handle one specific commodity space. It's very rare that they will legitimately be evenly matched. Maybe just that fact alone is a helpful tool for customers to know that you should be continuing to dig in and say, but really, where are you? Show me the spread of your customer base. How are you solving these problems that are true for my commodity space, et cetera. So I think that's one thing that has been unexpected to me as I've kind of grown up in this space is I came in thinking there was all this competition. In reality, these are just really great salespeople who are doing their jobs excellently. But when you get right down to it, there are usually only one or two that would be a right fit for that commodity space. So that's just something to keep in mind. So the second piece I would say is to pursue recommendations. So even before you go into a conversation where it's like, what are all the options? Spend a real amount of time working on your commercial network and get connected to other organizations and see what are the challenges they've experienced. Just really you can learn a lot taking somebody out to dinner and saying, hey, tell me the journey that you've walked. And I think most people don't want other people to experience difficulty and we have compassion for one another. I think people are prone to share those lessons and I think that can save your organization seven figure sorts of numbers easily. So I think those would be the two right there. And then maybe the last one is maybe finding a relationship with an Si or a software selection provider who is going to kind of tell you things that might not be comfortable to hear and maybe you got to get somebody to shoot you straight and sometimes that can be difficult. But there are those people out there. I'll just say it like now, speaking.

HOWARD WALPER

Of good salesmen, sterling, I'd be remiss if I didn't mention that you can also get some good information on this at our Energy Trading Week and Commodity Trading Week conferences in London and Houston and Singapore. So I just had to get that in there. Since you mentioned good, let's wrap this up with a look at the future. And you've touched on this throughout this talk, but maybe as sort of a statement that we can leave people with where do you think the CTRM industry is going? What do you think the future of CTRM is going to be technologically?

STERLING CARMEAN

Yeah, I think that there is a massive opportunity for innovation happening right now. I do think that there is a moment here in the market where we're seeing this congealing of all platforms or not all. I appreciate many platforms. One vendor is creating an opportunity for people to press against the status quo. And I think that that is really in capital markets. These are capital opportunities that people love to see this kind of open market, free trade. Let's compete and may the best win. I think everyone in this sector is highly aligned to that sort of thinking. I think that there is an opportunity to see a major step of innovation happen right now, as we have kind of almost cleared the field, so to speak, with each of the major platforms kind of running in their specific lane, as it were. Now there's a huge opportunity for new entries. And I do think that that new entry, when we think that, we think, oh my gosh, it's going to be so difficult for somebody to build the next CTRM system. That's years and years of work to do. Who is going to invest in that? And I think I would say I think the future looks maybe a little different than how we've seen that problem solved in the past. And so I am just with everyone I'm speaking to, I'm trying to encourage that your organization can set the bar of innovation is not too high, that your organization can step into this space. We have a number of customers that we aren't consulting to build their thing. They are engaging us to teach them how to build the tools for themselves. And we are so excited for that. So we need people seeing the problems in their area, building solutions for them and working through those kinds of things together. So I think we're certainly growing up in an era where my kids can code on an iPad now and that wasn't the case 25 years ago, right? So the barrier to entry for people to understand technological concepts is much lower. And so I think this is a great moment for us to be stepping forward as a market. I think there is a risk that we view technological advancement as someone else's problem if we do that. I think we run a serious risk of stagnation in this market over the next ten and 15 years. Should the market stay as it is today, there will be no material leap forward. And so it's really upon each one of us who have the ability to make an impact to do that now and to make a change and to hear the needs of customers, to understand the innovation that users are expecting in this new generation of technology and to work hard together to deliver those things. So I think it's an incredibly exciting moment and I think that with each of us running in our lanes, I think we can make this a completely different world five and ten years from now.

HOWARD WALPER

That's a great way to wrap it up. I really appreciate your perspective and so thank you very much for being part of this today.

STERLING CARMEAN

Yeah. Thank you, Howard. Good to see you. It's been great.

HOWARD WALPER

Everybody, once again, thank you to sterling Carmine from Triarc solutions for being our guest today. Please continue to check back for more insight from the industry here at energy trading insider and commodity trading insider. And, of course, check out some of the energy trading week commodity trading week conferences at a location near you. So thank you very much and have a great day. Bye.

Written by: Commodities People

Data ETRM Future Trends Interoperability Videos

labelAll Posts todaySeptember 5, 2023

The CEO of cQuant.io, a leading player in advanced energy and commodity analytics models discusses a wide range of topics, including the ongoing clean energy transition, the importance of model [...]

labelAll Posts todayMay 15, 2024

Ohio’s net metering program allows you to get credits for surplus energy you produce, which you can apply to future utility bills. The post Ohio Net Metering appeared first on [Read More]

According to the Database of State Incentives for Renewable Energy (DSIRE), Illinois’s net metering policy requires that customers who produce electricity using clean power can take advantage of net metering. [Read More]

The world is getting warmer. Scientists and climate experts say this is because of too many greenhouse gases (GHG) in the air, such as carbon dioxide and methane. These gases [Read More]

Energy systems are becoming smarter and more connected. But with new technology comes new risks. One of the biggest concerns is cybersecurity in energy systems. This means keeping energy infrastructure [Read More]

Understanding energy laws and their impact on energy can help you better comprehend how they affect you and your energy needs. Below, we outline how lawmakers, regulators, and courts steer [Read More]

RSS Error: A feed could not be found at `https://www.energyvoice.com/feed`; the status code is `403` and content-type is `text/html; charset=UTF-8`

Information on energy prices from July 2025, including a breakdown of rates and charges for every region on Flexible Octopus. [Read More]

Get rewarded using energy when the grid is green with Octopus Energy Turn Up Sessions. Instead of wasting all that clean energy, we’d like you to use it up instead. [Read More]

You can make a profit on your electricity bill on the Intelligent Octopus Flux tariff, or save around 90% with Fixed Outgoing. We dig into how saving with solar really [Read More]

Zero Bills Global Standard [Read More]

How zonal pricing could wipe millions off the electricity bills of businesses in critical industrial sectors, including steel, chemicals, car manufacturing, and data. [Read More]

As hurricane season intensifies and summer camping trips peak, access to reliable backup power becomes more important than ever. Whether you’re bracing for a sudden outage or powering devices off-grid, [Read More]

But going back on the 2035 zero-emissions target and deploying no industrial strategy could instead see loss of 1 million auto jobs. Europe’s car industry could return to producing 16.8 [Read More]

T&E’s William Todts looks at whether a climate deal that potentially doubles the global biofuels market can be considered a good deal? On the banks of the River Thames in [Read More]

We recently received the Bluetti Elite 200 V2 to review, and we put it to the test. We plugged in all kinds of devices, and even half of a home, [Read More]

Elon Musk likes to get his own way. When his offer to assist in the Thai children’s cave rescue was rejected, he accused the team leader of pedophilia. He moved [Read More]

How will the EU contribute to global efforts to reduce greenhouse gas emissions during the 2030s? The EU should have come up with a plan already last year if it [Read More]

Most observers think of heat pumps as small-scale heating systems for houses, businesses and apartment buildings. But XXL heat pumps are already in service and doing the same job for [Read More]

After years of setbacks, the UK is finally pushing ahead with two carbon capture and storage projects. While there is scepticism about the technology, says Ros Taylor, its supporters argue [Read More]

In 2019, the EU set into motion dedicated legislation to expand renewable energy communities (RECs) where they already exist, and enable citizen energy in countries – mostly eastern and southern [Read More]

Peatlands[1] account for 3% of the world’s land surface. As long as they are intact, they store large quantities of carbon dioxide (CO₂), one of the greenhouse gases (GHG) accelerating [Read More]

The House version of Donald Trump’s “Big Beautiful” budget bill almost completely repeals the provisions of Joe Biden’s signature Inflation Reduction Act (IRA). In particular, the tax credits for homeowners [Read More]

By Tom Konrad, Ph.D., CFA Supply and Demand One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, [Read More]

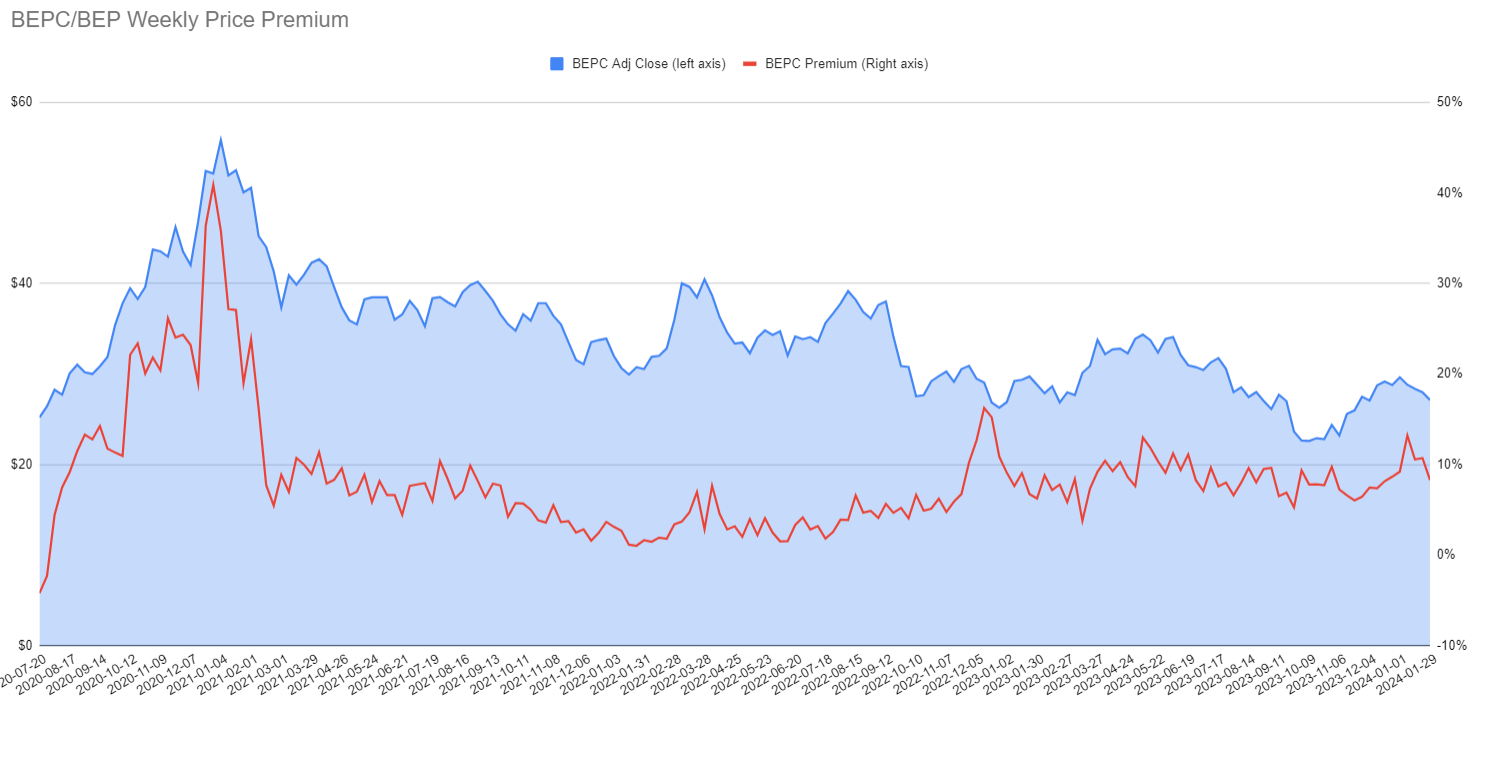

By Tom Konrad, Ph.D., CFA On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. [Read More]

By Tom Konrad, Ph.D., CFA A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A [Read More]

By Tom Konrad Ph.D., CFA Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. [Read More]

With the heat of summer blazing across the United States, you’ve probably given some thought on how to cool down. One appliance that could help is the humble air-source heat [Read More]

With Memorial Day weekend now in the rearview mirror, summer is “unofficially” here. But before the hottest weather of the year rolls in, there’s still plenty of time to make [Read More]

In an era of rising energy costs and growing concerns about grid reliability, power companies around the country are offering demand response programs to help consumers manage electricity use while [Read More]

As springtime rolls in, the season of rejuvenation extends beyond gardens and closets – it’s the perfect time to make changes that can improve how you use energy at home. [Read More]

Thinking about making the switch to an electric vehicle (EV) but unsure where to start? You're not alone. The rapid rise in EV popularity has many consumers considering a move [Read More]

The race is on. Accenture explains why US energy companies will soon be fighting to be methane-mitigation pacesetters. [Read More]

A review of energy sector M&A approaches over the past decade sheds light on four inorganic growth pathways energy companies should consider. [Read More]

Accenture and the World Economic Forum identify five actions to get industries on track for net zero. [Read More]

Accenture identifies three IT enablers of innovation that upstream operators should develop or strengthen to remodel technology. [Read More]

Learn about the six key insights into why—and how—the energy transition must be accelerated. [Read More]

Recurrent Energy has reached commercial operation of the 1200 MWh Papago storage facility in Maricopa County, Arizona. [Read More]

The ORLEN Group, in partnership with Northland Power, has commenced the installation of Europe’s largest offshore wind turbines, each with a capacity of 15 MW. [Read More]

SAB WindTeam has ordered 13 N163/6.X turbines with a total capacity of 91 MW from the Nordex Group. [Read More]

EnergyAustrlia has partnered with Banpu Energy Australia to develop the Wooreen energy storage system. [Read More]

Mammoet has signed a support agreement for TenneT’s 2 GW programme supporting offshore installations. [Read More]

Copyright 2023 Commodities People

MOLECULE

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

MOLECULE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

cQuant.io

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

CAPSPIRE

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

CAPSPIRE

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

DIGITERRE

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

DIGITERRE

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

EMSYSVPP

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

EMSYSVPP

GOLD SPONSOR

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

ENERGY & METEO SYSTEMS

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

ENERGY & METEO SYSTEMS

GOLD SPONSOR

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

FIS

GOLD SPONSOR

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

deltaconX

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

deltaconX

GOLD SPONSOR

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

Energy Exemplar

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

Energy Exemplar

SPONSOR

Energy Exemplar: Headquartered in Adelaide, Australia – with offices in the US, Europe, North and South America, and Asia – Energy Exemplar helps 500+ customers, comprising a large share of the world’s top energy market stakeholders across 73 countries, to analyse scenarios for the most accurate outcomes while supporting their organisational and digital transformation. Through their PLEXOS® platform, the market-leading integrated energy simulation software, Energy Exemplar supplies solutions across the electric, gas and renewable markets and supports infrastructure projects worldwide.

Energy Exemplar also provides cutting-edge capabilities for energy trading companies. By leveraging PLEXOS®, users can digitally replicate real-world energy markets, incorporating comprehensive datasets related to electric power, water, and gas. This powerful simulation capability allows users to explore various scenarios and understand the potential risks and opportunities associated with different market conditions. The sophisticated capabilities of PLEXOS facilitate crucial tasks such as trading, generation scheduling, capacity expansion, and market analysis across multiple industry sectors. Energy market participants can gain valuable insights into price forecasting, market trends, and supply-demand dynamics, enhancing their ability to optimise trading strategies and mitigate risks.

REDEX

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

REDEX

SPONSOR

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

ENERGY TRADERS ASSOCIATION

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

ENERGY TRADERS ASSOCIATION

ASSOCIATION PARTNER

Energy Traders Association (ETD) was founded by leading energy trading companies holding Electricity Wholesale Licenses in 2010 to promote liberal energy trading and development of sustainable, transparent and liquid markets in Turkey. The Istanbul-based Association currently has 54 members.

ETD is mandated to facilitate and promote universal rules, regulations and standards enabling a fair trading environment towards a liberal energy market. ETD’s functions include not only the establishment of preliminary infrastructure ensuring transparent and accessible prices and market information for all, but also the introduction of a widely accepted standard contract and defining and establishment of an ethical code. In order to fulfil its objectives, ETD cooperates with many national and international Governmental and Non-Governmental institutions.

In terms of national connections and works, ETD participates in and organizes joint working groups including both members of ETD and Institutions with Ministry of Energy and Natural Resources, Energy Markets Regulation Authority, Competition Board, TEİAŞ (Turkish System Operator), EPİAŞ (Energy Markets Operation Company), Istanbul Exchange etc. Main subjects of this joint work are liberalization and competition, standardization, legal infrastructure of both wholesale and retail trade issues, transparency. We are proud of being very active during process of foundation of EPİAŞ, structuring products transacted in Istanbul Exchange and development of volume and operational enhancement of OTC markets in Turkey.

In terms of international connections, ETD and EFET (European Federation of Energy Traders) organized multiple meetings introducing the EFET Agreement to market participants and created a working group on the adaptation of the EFET Agreement into the Turkish market. Finally, EFET General Agreement Turkey version (EFET TR) was launched on 22 July 2011, which was followed by the execution of the first agreement by two leading companies in Turkey. Our efforts and studies towards introducing demand response management to the Turkish energy market in cooperation with some European companies and institutions came to a visible level in regulatory frameworks. We are one of the energy sector organisations, which is invited to consultation meetings and interviews for various reports on the Turkish energy market, prepared by international organisations such as The World Bank Group and International Energy Agency.

STA

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

STA

ASSOCIATION PARTNER

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

EUROPEAN ENERGY RETAILERS

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

EUROPEAN ENERGY RETAILERS

ASSOCIATION PARTNER

The European Energy Retailers (EER) represent the voice of Independent Energy & Solution Providers in EU-wide policy discussions. In order to achieve a well-functioning retail energy market, new suppliers and service providers must be able to enter into and compete in the market on equal terms.

ENERGY TRADERS EUROPE

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

ENERGY TRADERS EUROPE

ASSOCIATION PARTNER

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

AIGET

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

AIGET

ASSOCIATION PARTNER

AIGET: Associazione Italiana di Grossisti di Energia e Trader / The Italian Association of Energy

Traders & Suppliers (www.aiget.org)

Created in 2000, with the beginning of the liberalization of the Italian energy markets, AIGET represents and promotes the interests of the Italian and foreign entrants in the supply, trading & shipping of electricity, natural gas and related services & certificates. The main targets of the Association are the promotion of competition, transparency and liquidity in the Italian energy markets & supporting the development and standardization of tradable energy products and contracts, including energy & weather derivatives.

CTRMCENTER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

CTRMCENTER

GOLD MEDIA PARTNER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

TRADE FINANCE GLOBAL

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

TRADE FINANCE GLOBAL

MEDIA PARTNER

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

Post comments (0)